Rising Demand for Efficiency

The advanced distribution-management-systems market is experiencing a notable surge in demand for operational efficiency. Companies are increasingly seeking solutions that streamline their distribution processes, reduce lead times, and enhance overall productivity. In the UK, businesses are projected to invest approximately £1.5 billion in advanced distribution technologies by 2026, reflecting a growing recognition of the need for efficient supply chain management. This trend is driven by the competitive landscape, where firms must optimize their operations to maintain market share. As a result, advanced distribution-management-systems are becoming essential tools for organizations aiming to improve their logistics and distribution capabilities.

Focus on Cost Reduction Strategies

Cost reduction remains a critical focus for businesses operating within the advanced distribution-management-systems market. In the UK, organizations are under constant pressure to minimize operational costs while maintaining service quality. This has led to an increased adoption of advanced distribution technologies that optimize resource allocation and reduce waste. It is estimated that companies can achieve cost savings of up to 15% by implementing these systems effectively. As firms strive to enhance their profitability, the demand for advanced distribution-management-systems is likely to grow, driven by the need for sustainable cost management.

Regulatory Compliance and Standards

Regulatory compliance is increasingly influencing the advanced distribution-management-systems market. In the UK, businesses are required to adhere to stringent regulations regarding safety, environmental impact, and data protection. This necessitates the implementation of advanced systems that can ensure compliance while optimizing distribution processes. Companies are investing in technologies that facilitate adherence to these regulations, which is projected to account for approximately 20% of the total expenditure on distribution systems by 2026. As a result, advanced distribution-management-systems are becoming indispensable for organizations aiming to navigate the complex regulatory landscape.

Technological Advancements in Logistics

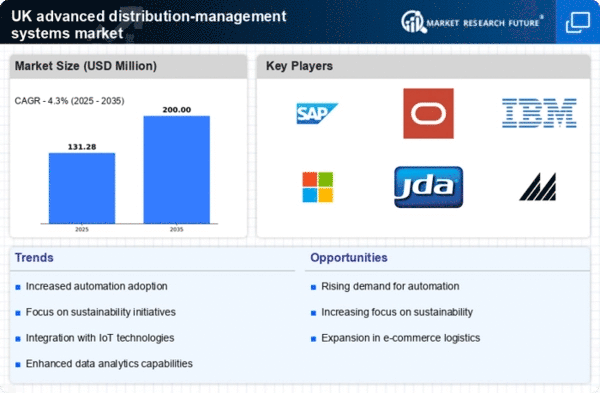

Technological innovations are significantly shaping the advanced distribution-management-systems market. The integration of cutting-edge technologies such as IoT, machine learning, and blockchain is transforming how distribution networks operate. In the UK, the logistics sector is expected to grow at a CAGR of 4.5% from 2025 to 2030, indicating a robust demand for advanced systems that can leverage these technologies. These advancements enable real-time tracking, enhanced inventory management, and improved decision-making processes. Consequently, businesses are increasingly adopting advanced distribution-management-systems to stay competitive and meet the evolving demands of consumers.

E-commerce Growth and Consumer Expectations

The rapid expansion of e-commerce is a pivotal driver for the advanced distribution-management-systems market. As online shopping continues to gain traction in the UK, consumer expectations for fast and reliable delivery are rising. Reports indicate that e-commerce sales in the UK reached £200 billion in 2025, prompting retailers to invest in sophisticated distribution solutions. To meet these demands, companies are turning to advanced distribution-management-systems that facilitate efficient order fulfillment and logistics operations. This shift not only enhances customer satisfaction but also positions businesses to capitalize on the growing e-commerce landscape.