Emergence of Edge Computing

The emergence of edge computing is reshaping the IT Infrastructure Services Market. As the demand for real-time data processing and low-latency applications increases, organizations are investing in edge computing solutions to enhance their IT infrastructure. This trend is particularly evident in sectors such as manufacturing, healthcare, and telecommunications, where immediate data analysis is crucial. Market forecasts indicate that the edge computing market could grow significantly, potentially reaching 20 billion dollars by 2026. This growth is likely to drive further investments in IT infrastructure services that support edge computing capabilities, thereby transforming the landscape of the IT Infrastructure Services Market.

Increased Focus on Data Security

In the current landscape, the IT Infrastructure Services Market is witnessing an intensified focus on data security. With the rise in cyber threats and data breaches, organizations are compelled to invest in robust IT infrastructure that prioritizes security measures. Recent statistics indicate that cybersecurity spending is expected to reach over 200 billion dollars by 2025, reflecting the urgent need for secure IT environments. This trend is driving demand for infrastructure services that incorporate advanced security protocols and compliance measures. As businesses recognize the critical importance of safeguarding sensitive information, the IT Infrastructure Services Market is likely to see sustained growth in security-focused service offerings.

Adoption of Hybrid Cloud Solutions

The IT Infrastructure Services Market is increasingly influenced by the adoption of hybrid cloud solutions. Organizations are recognizing the benefits of combining on-premises infrastructure with cloud services to achieve greater flexibility and cost efficiency. Recent market analysis suggests that the hybrid cloud segment is expected to account for a significant portion of the overall IT infrastructure services market, with a projected growth rate of around 15% annually. This shift allows businesses to optimize their IT resources while maintaining control over sensitive data. As more companies transition to hybrid models, the IT Infrastructure Services Market is poised for substantial expansion.

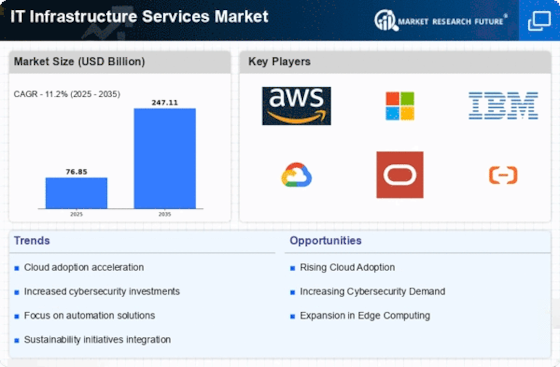

Rising Demand for Digital Transformation

The IT Infrastructure Services Market is experiencing a notable surge in demand driven by the ongoing digital transformation initiatives across various sectors. Organizations are increasingly investing in IT infrastructure to enhance operational efficiency and improve customer experiences. According to recent data, the market for IT infrastructure services is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is largely attributed to the need for scalable and flexible IT solutions that can support evolving business models. As companies strive to remain competitive, the emphasis on upgrading IT infrastructure becomes paramount, thereby propelling the IT Infrastructure Services Market forward.

Growing Need for IT Infrastructure Modernization

The IT Infrastructure Services Market is witnessing a growing need for infrastructure modernization as organizations seek to replace outdated systems with more efficient technologies. This modernization is essential for improving performance, reducing operational costs, and enhancing service delivery. Recent data suggests that nearly 60% of enterprises are prioritizing IT infrastructure upgrades to support their digital initiatives. As businesses recognize the limitations of legacy systems, the demand for modern IT infrastructure services is expected to rise. This trend not only fosters innovation but also positions the IT Infrastructure Services Market for continued growth as companies strive to remain agile and competitive.