Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices is transforming the landscape of the Big Data Market. With billions of connected devices generating vast amounts of data, organizations are compelled to adopt big data solutions to manage and analyze this influx. It is estimated that by 2025, the number of connected IoT devices could exceed 75 billion, creating unprecedented opportunities for data collection and analysis. This surge in data generation necessitates sophisticated big data technologies to process and extract meaningful insights. Consequently, the Big Data Market is poised for growth as businesses seek to harness the potential of IoT data to enhance operational efficiency and innovate their service offerings.

Rising Demand for Data Analytics

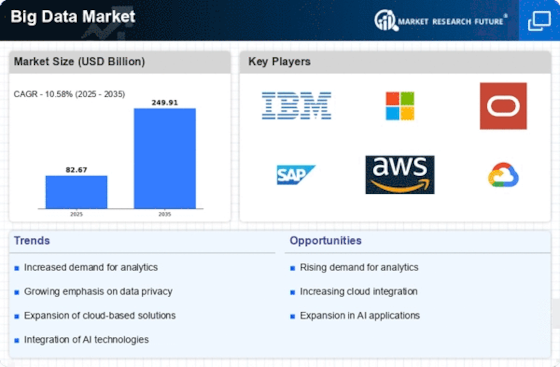

The increasing reliance on data-driven decision-making across various sectors appears to be a primary driver for the Big Data Market. Organizations are recognizing the value of data analytics in enhancing operational efficiency and customer engagement. According to recent estimates, the data analytics market is projected to reach approximately 274 billion USD by 2025, indicating a robust growth trajectory. This demand is fueled by the need for businesses to derive actionable insights from vast amounts of data, thereby fostering a competitive edge. As companies invest in advanced analytics tools, the Big Data Market is likely to experience significant expansion, with a focus on integrating these tools into existing workflows.

Advancements in Data Storage Technologies

Innovations in data storage technologies are playing a crucial role in shaping the Big Data Market. The advent of cloud storage solutions and distributed databases has enabled organizations to store and manage vast datasets more efficiently. As of 2025, The Big Data Market is anticipated to reach around 137 billion USD, reflecting a growing trend towards scalable and flexible storage options. These advancements allow businesses to leverage big data analytics without the constraints of traditional storage systems. As organizations increasingly adopt these technologies, the Big Data Market is likely to witness accelerated growth, driven by the need for efficient data management and retrieval.

Regulatory Compliance and Data Governance

The increasing emphasis on regulatory compliance and data governance is emerging as a significant driver for the Big Data Market. Organizations are under pressure to adhere to stringent data protection regulations, which necessitate robust data management practices. The global market for data governance solutions is projected to reach approximately 2.5 billion USD by 2025, highlighting the growing importance of compliance in data strategies. This trend compels businesses to invest in big data solutions that ensure data integrity and security. As companies navigate the complexities of regulatory requirements, the Big Data Market is expected to expand, driven by the demand for compliant data management frameworks.

Growing Importance of Real-Time Data Processing

The shift towards real-time data processing is becoming increasingly vital for organizations aiming to remain competitive in the Big Data Market. Businesses are recognizing the need to analyze data as it is generated to make timely decisions and respond to market changes. The real-time analytics market is projected to grow significantly, potentially reaching 30 billion USD by 2025. This growth is indicative of the demand for technologies that facilitate immediate data insights. As organizations prioritize agility and responsiveness, the Big Data Market is likely to benefit from the adoption of real-time processing solutions, enabling them to leverage data for strategic advantage.