Market Analysis

In-depth Analysis of Interactive Video Wall Market Industry Landscape

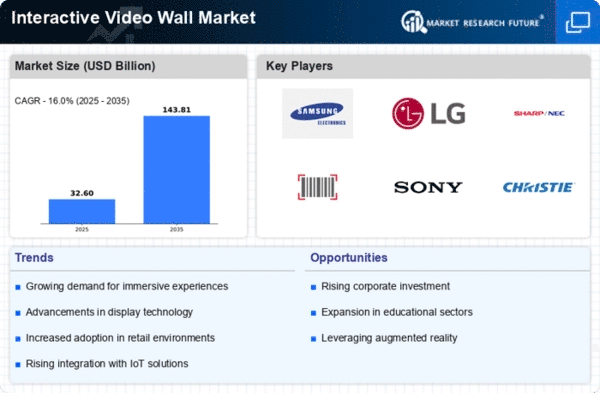

The growing need for engaging and intense visual experiences in many fields is a key factor moving the business forward. Businesses, schools, and companies are using interactive video walls more and more to improve communication, keep viewers interested, and encourage people to work together to make decisions.

New developments in technology have a big effect on how markets work. The uses of interactive video walls have grown as touch-sensitive technology, high-resolution screens, and dynamic apps have gotten better over time. Now there are more uses, which makes these systems more flexible and appealing to a wider range of end users.

live video boards are used a lot in the business world for things like presentations, workplace talks, and live data display. These systems may turn boring, static information into interesting, moving material in order to get people more involved and help them understand. As long as businesses are looking for new ways to meet and work together in an international, digital world, this trend is likely to keep going.

Teachers have had to rethink how they teach in ways that have been used for a long time since interactive video walls came out. Schools use these tools to make learning settings that are interesting, interactive, and get students involved. Big dynamic screens make learning more fun by showing complicated ideas in a way that is easier to understand and remember.

Many more interactive video walls are being needed in the hotel and entertainment industries compared to earlier. Video walls are used for many things in these fields, like digital signs, interactive shows, and screens that change the material all the time. Making customer encounters better by making settings that look good and are fun to deal with could lead to more lasting and interesting interactions.

There is an extra level of complication because the market trends may be different in different regions. Countries that have a strong IT infrastructure and a lot of extra cash are usually the first to use interactive video wall systems. However, developing countries are catching up as they improve their technology and realize the many ways these systems can help different areas.

A unique thing about the competitive world is that it has big companies that are always coming up with new ideas to get ahead. Many businesses are putting a lot of money into research and development to make it easier to add new features. These skills include being able to understand motions, talk to multiple people at once, and easily work with other devices. To keep growing as the industry changes, it is important to focus on making options that are cheaper without lowering efficiency.

Leave a Comment