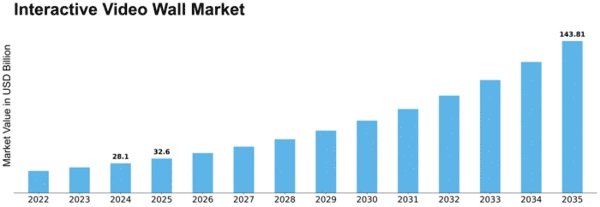

Interactive Video Wall Size

Interactive Video Wall Market Growth Projections and Opportunities

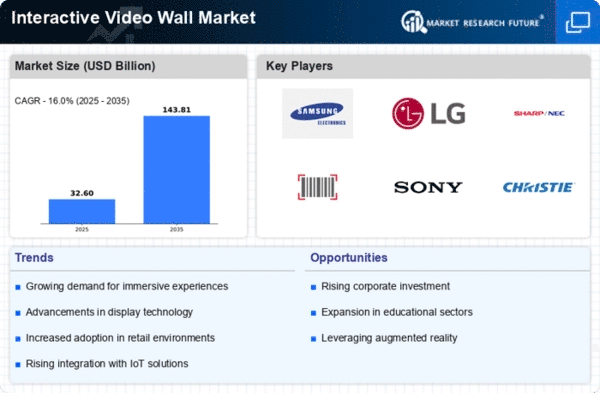

One big thing pushing the market forward is how important visual communication and interaction are becoming in a lot of different fields. More businesses, schools, and entertainment venues are learning that interactive video walls can help with marketing, sharing information, and building teams, so the need for these solutions is growing.

How the display business changes depends a lot on how easy it is to get new technologies and how much they cost. As industrial methods get better and economies of scale take hold, it becomes cheaper to make high-quality screens. As the cost of interactive video walls goes down, more people can afford to use them. This makes them more popular in a wide range of businesses and age groups.

Adding smart technology and internet access to places with live video walls is a big business idea. Thanks to the widespread use of IoT technology, interactive video walls can easily connect to other systems and devices. This makes the user experience more united and in sync. Interactive video walls can talk to data streams, monitors, and other smart devices through this link, which makes them more useful.

Since end-user demand and tastes have a big impact on the market, businesses and groups are always looking for new ways to improve connection and interaction. Companies are using interactive video walls more and more to make presentations better, get more people to conferences, and boost teamwork at work. Interactive video walls are used a lot in business settings because people want to communicate in more interesting and dynamic ways.

The schooling system is also very important to the business. Schools are using more and more digital learning tools at the same time that interactive video boards are being used in more and more classes to make learning more fun and active. The goal is to improve learning, get students interested, and use technology to make difficult subjects easier to understand.

Market trends can be affected by differences in how economies grow and how quickly new technologies are adopted across areas. The first places to use interactive video walls are usually those that are technologically advanced and have a strong infrastructure. Emerging economies, on the other hand, are making up ground because they are investing more in technology than wealthy countries. Different regions have different rules, tastes, and cultural effects that make the interactive video wall business very different.

Leave a Comment