Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver within the Injection Molding Machinery Market. Manufacturers are increasingly adopting eco-friendly practices, such as using biodegradable materials and energy-efficient machines, to align with global sustainability goals. The market for sustainable injection molding solutions is projected to grow by 20% over the next five years, reflecting a shift towards environmentally responsible production methods. Companies are also investing in recycling equipment technologies to minimize waste and enhance material recovery. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers. As a result, the Injection Molding Machinery Market is likely to see a rise in demand for sustainable machinery and practices, fostering innovation and competitiveness.

Technological Advancements

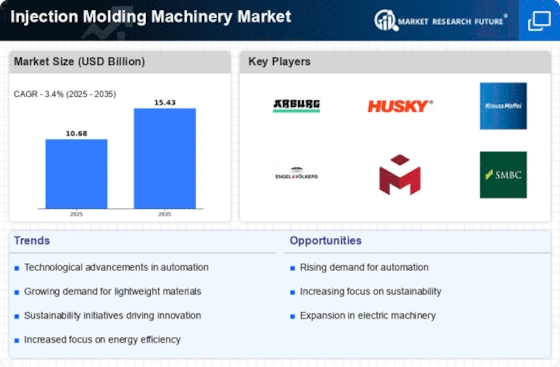

The Injection Molding Machinery Market is experiencing a surge in technological advancements, particularly in the areas of machine efficiency and precision. Innovations such as electric injection molding machines are gaining traction due to their energy efficiency and reduced carbon footprint. According to recent data, the adoption of these advanced machines is projected to increase by approximately 15% annually. Furthermore, the integration of Industry 4.0 technologies, including IoT and AI, is enhancing operational efficiency and predictive maintenance capabilities. This trend not only reduces downtime but also optimizes production processes, making manufacturers more competitive. As companies strive to meet rising consumer demands for quality and speed, the emphasis on technological innovation within the Injection Molding Machinery Market, particularly in plastic molding machines, is likely to intensify.

Customization and Product Development

The need for customization and rapid product development is increasingly shaping the Injection Molding Machinery Market. As consumer preferences evolve, manufacturers are compelled to produce tailored products that meet specific market demands. This trend is particularly evident in sectors such as consumer electronics and packaging, where unique designs and functionalities are paramount. Data suggests that the market for customized injection molding solutions is expected to grow by 12% annually, driven by the need for shorter production cycles and enhanced flexibility. Consequently, machinery that offers quick changeover capabilities and versatile configurations is becoming essential. This emphasis on customization is likely to propel the Injection Molding Machinery Market forward, as companies seek to differentiate themselves in a competitive landscape.

Rising Demand from End-User Industries

The Injection Molding Machinery Market is significantly influenced by the rising demand from various end-user sectors, including automotive, consumer goods, and healthcare. The automotive sector, in particular, is projected to account for a substantial share of the market, driven by the need for lightweight and durable components. Data indicates that the automotive industry alone is expected to grow at a rate of 10% annually, thereby increasing the demand for advanced injection molding machinery. Additionally, the healthcare sector's focus on producing high-quality medical devices and packaging solutions is further propelling market growth. As these industries expand, the Injection Molding Machinery Market is poised to benefit from increased investments in machinery and technology to meet evolving production needs.

Economic Growth and Industrial Expansion

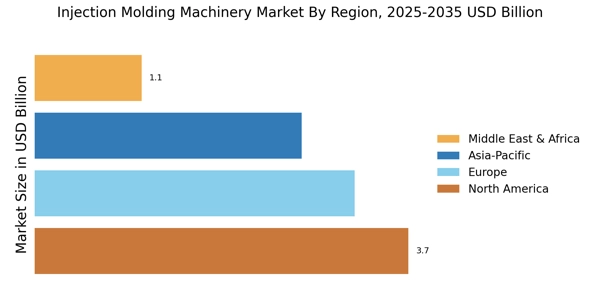

Economic growth and industrial expansion are critical factors influencing the Injection Molding Machinery Market. As economies recover and expand, there is a corresponding increase in manufacturing activities across various sectors. The demand for injection molding machinery is expected to rise in tandem with industrial output, particularly in emerging markets where infrastructure development is underway. Recent projections indicate that the manufacturing sector could grow by 8% annually, leading to heightened investments in machinery and technology. This growth is likely to stimulate demand for injection molding solutions that enhance production efficiency and product quality. As industries expand, the Injection Molding Machinery Market is positioned to capitalize on these economic trends, fostering innovation and investment in advanced machinery.