Rising Industrial Automation

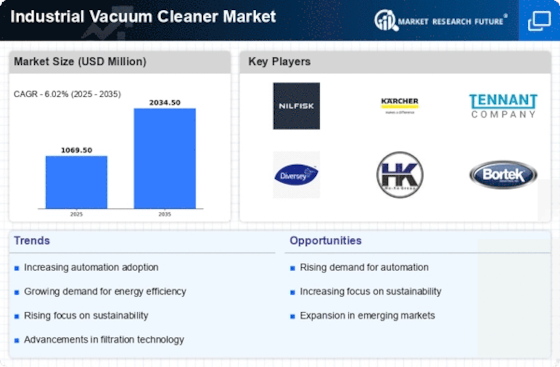

The increasing trend of industrial automation appears to be a pivotal driver for the Industrial Vacuum Cleaner Market Industry. As industries adopt automated processes, the need for efficient cleaning solutions becomes paramount. Automated systems often generate dust and debris, necessitating advanced vacuuming technologies to maintain cleanliness and safety. The market for industrial vacuum cleaners is projected to grow at a compound annual growth rate of approximately 5.5%, driven by this automation trend. Companies are investing in high-performance vacuum systems that can integrate seamlessly with automated machinery, ensuring that production environments remain free from contaminants. This integration not only enhances operational efficiency but also contributes to the longevity of equipment, thereby reinforcing the demand for industrial vacuum cleaners.

Growth in Manufacturing Sector

The ongoing expansion of the manufacturing sector is a significant driver for the Industrial Vacuum Cleaner Market Industry. As manufacturing activities increase, so does the generation of waste materials, dust, and debris, which necessitates effective cleaning solutions. The manufacturing sector is projected to grow at a steady pace, with estimates suggesting an increase in output by approximately 4% annually. This growth directly correlates with the rising demand for industrial vacuum cleaners, as manufacturers seek to maintain clean and safe working environments. Furthermore, the adoption of advanced vacuum technologies, such as those equipped with HEPA filters, is becoming more prevalent, as manufacturers aim to enhance air quality and comply with health regulations. This trend indicates a robust market potential for industrial vacuum cleaners in the manufacturing domain.

Stringent Regulatory Standards

The enforcement of stringent regulatory standards regarding workplace safety and environmental protection is likely to bolster the Industrial Vacuum Cleaner Market Industry. Regulations often mandate the use of specialized cleaning equipment to mitigate hazards associated with dust and particulate matter. For instance, industries such as pharmaceuticals and food processing are subject to rigorous cleanliness standards, which necessitate the use of high-efficiency vacuum systems. The market is expected to witness a surge in demand for industrial vacuum cleaners that comply with these regulations, as companies strive to avoid penalties and ensure worker safety. This compliance not only enhances operational integrity but also positions businesses favorably in competitive markets, thereby driving the growth of the industrial vacuum cleaner sector.

Increased Focus on Health and Safety

The heightened focus on health and safety in industrial environments is emerging as a crucial driver for the Industrial Vacuum Cleaner Market Industry. Organizations are increasingly recognizing the importance of maintaining clean workspaces to prevent health hazards associated with dust and airborne particles. This awareness has led to a growing investment in advanced cleaning technologies, including industrial vacuum cleaners that offer superior filtration and suction capabilities. The market is witnessing a shift towards vacuum systems that not only clean effectively but also contribute to improved air quality. As companies prioritize employee well-being, the demand for industrial vacuum cleaners is expected to rise, reflecting a broader commitment to health and safety standards across various industries.

Technological Innovations in Vacuum Systems

Technological innovations within the vacuum cleaner sector are likely to propel the Industrial Vacuum Cleaner Market Industry forward. Advancements in design, efficiency, and functionality are transforming traditional vacuum systems into sophisticated cleaning solutions. Features such as smart technology integration, energy-efficient motors, and enhanced filtration systems are becoming increasingly common. These innovations not only improve cleaning performance but also reduce operational costs for businesses. The market is projected to see a significant uptick in demand for vacuum cleaners that incorporate these advanced technologies, as companies seek to optimize their cleaning processes. Furthermore, the introduction of IoT-enabled vacuum systems allows for real-time monitoring and maintenance, which could further enhance operational efficiency and drive market growth.