Market Trends

Key Emerging Trends in the Industrial Sensors Market

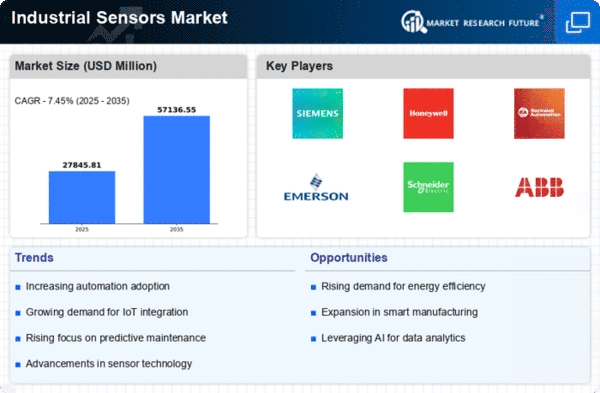

The industrial sensors market is experiencing robust growth and rapid evolution driven by the increasing adoption of automation, digitization, and IoT (Internet of Things) technologies across various industries. Industrial sensors play a critical role in monitoring, measuring, and controlling physical parameters such as temperature, pressure, vibration, and flow in manufacturing processes, machinery, and infrastructure. As we delve into the market trends of industrial sensors, several key factors emerge that are shaping its trajectory.

One prominent trend in the industrial sensors market is the growing demand for advanced sensor technologies capable of providing real-time data and insights for predictive maintenance, process optimization, and quality control. With the rise of Industry 4.0 initiatives and smart manufacturing practices, there is a heightened focus on leveraging sensor data to improve operational efficiency, reduce downtime, and enhance product quality. Smart sensors equipped with wireless connectivity, edge computing capabilities, and predictive analytics algorithms enable proactive maintenance interventions, enabling organizations to detect equipment failures and performance deviations before they lead to costly disruptions or defects.

Moreover, the convergence of industrial sensors with IoT and cloud computing technologies is driving innovation in the industrial sensors market, enabling seamless integration with data analytics platforms, enterprise systems, and digital twin simulations. IoT-enabled sensors collect and transmit data to cloud-based platforms, where it is aggregated, analyzed, and visualized to provide actionable insights for decision-making and process optimization. By leveraging IoT connectivity and cloud-based analytics, organizations can gain visibility into their operations, monitor asset health in real time, and implement data-driven strategies to improve efficiency, productivity, and competitiveness.

Another significant trend shaping the industrial sensors market is the increasing adoption of MEMS (Micro-Electro-Mechanical Systems) sensors, which offer miniature size, low power consumption, and high sensitivity, making them ideal for a wide range of industrial applications. MEMS sensors are commonly used in applications such as motion sensing, inertial navigation, environmental monitoring, and gas detection, enabling precise measurement and control of physical parameters in harsh and demanding environments. As MEMS technology continues to advance and mature, the cost-effectiveness and performance advantages of MEMS sensors are driving their adoption in industrial automation, automotive, consumer electronics, and healthcare sectors.

Furthermore, the market for industrial sensors is witnessing a shift towards smart sensor solutions that integrate multiple sensing modalities, communication interfaces, and embedded intelligence to deliver comprehensive monitoring and control capabilities. Smart sensors combine traditional sensing elements with microcontrollers, signal processing algorithms, and communication protocols to perform local data processing, decision-making, and communication with external systems. By embedding intelligence at the sensor level, smart sensors reduce data latency, bandwidth requirements, and reliance on centralized processing, enabling real-time responsiveness and distributed intelligence in industrial IoT deployments.

Additionally, the COVID-19 pandemic has accelerated the adoption of industrial sensors as organizations seek to enhance safety, efficiency, and resilience in their operations. Sensors equipped with temperature monitoring, occupancy detection, and social distancing alerts help businesses comply with health and safety regulations, mitigate the risk of viral transmission, and maintain business continuity in challenging environments. Similarly, remote monitoring and predictive maintenance enabled by industrial sensors support remote work and reduce the need for on-site personnel, contributing to operational efficiency and cost savings in the post-pandemic era.

Leave a Comment