Industrial Sensors Size

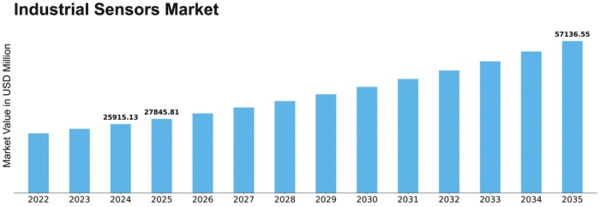

Industrial Sensors Market Growth Projections and Opportunities

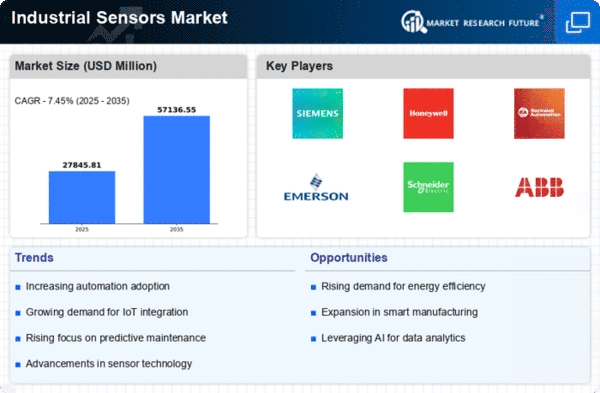

The industrial sensors market is significantly influenced by various key factors that shape its growth and dynamics. One essential factor is the increasing adoption of automation and Industry 4.0 initiatives across various industries. As companies strive to improve operational efficiency, reduce downtime, and optimize resource utilization, there is a growing demand for industrial sensors that enable real-time monitoring, data collection, and process control. Sensors play a crucial role in industrial automation by providing accurate measurements of various parameters such as temperature, pressure, humidity, vibration, and flow, enabling organizations to make informed decisions and streamline operations. The ongoing digital transformation of industries drives the need for advanced sensor technologies capable of supporting smart manufacturing, predictive maintenance, and quality control applications.

Moreover, technological advancements in sensor technology drive innovation and market growth in the industrial sensors market. Manufacturers continually invest in research and development to enhance sensor performance, reliability, and functionality. Advances in sensor miniaturization, wireless connectivity, and power efficiency enable the development of smaller, more versatile sensors that can be deployed in harsh industrial environments. Additionally, the integration of emerging technologies such as Internet of Things (IoT), artificial intelligence (AI), and edge computing enables the development of intelligent sensor systems capable of autonomously monitoring and analyzing vast amounts of data in real-time. These technological advancements expand the capabilities of industrial sensors and unlock new opportunities for applications in sectors such as manufacturing, automotive, aerospace, healthcare, and energy.

Furthermore, increasing emphasis on workplace safety and regulatory compliance drives demand for industrial sensors. Governments and regulatory bodies impose stringent safety and environmental regulations to protect workers, mitigate risks, and ensure compliance with industry standards. Industrial sensors play a crucial role in monitoring hazardous conditions, detecting leaks, and preventing accidents in industrial facilities. Sensors such as gas detectors, temperature sensors, and pressure sensors help organizations maintain safe working environments and comply with regulatory requirements. The growing awareness of occupational health and safety concerns underscores the importance of investing in reliable sensor solutions to safeguard employees and assets.

Supply chain dynamics also influence the industrial sensors market. The industry relies on a global network of suppliers, manufacturers, and distributors to source components, assemble products, and deliver them to end-users. Factors such as raw material availability, production capacity, and logistics can impact the supply chain's efficiency and reliability. Disruptions such as natural disasters, geopolitical tensions, or global pandemics can lead to shortages or delays in the availability of industrial sensors, affecting market dynamics and pricing. Manufacturers must proactively manage supply chain risks and establish resilient supply chains to ensure continuity of operations and meet customer demand.

Additionally, the growing demand for predictive maintenance and condition monitoring drives market growth in the industrial sensors market. Organizations are increasingly adopting predictive maintenance strategies to optimize asset performance, reduce unplanned downtime, and extend equipment lifecycles. Industrial sensors play a critical role in predictive maintenance by monitoring equipment health, detecting anomalies, and predicting potential failures before they occur. Sensors such as vibration sensors, temperature sensors, and infrared sensors provide valuable insights into equipment condition and performance, enabling organizations to implement proactive maintenance measures and avoid costly breakdowns. The shift towards predictive maintenance practices accelerates the adoption of industrial sensors across various industries, creating opportunities for sensor manufacturers and solution providers.

Competitive pressures also shape the industrial sensors market landscape. The market is highly competitive, with numerous manufacturers and vendors offering a wide range of sensor products and solutions. Factors such as product quality, performance, reliability, pricing, and customer support influence purchasing decisions. Manufacturers must differentiate their offerings through innovation, customization, and value-added services to gain a competitive edge. Strategic partnerships, collaborations, and acquisitions also play a significant role in shaping the competitive landscape and driving market growth.

Leave a Comment