Market Analysis

In-depth Analysis of Industrial Sensors Market Industry Landscape

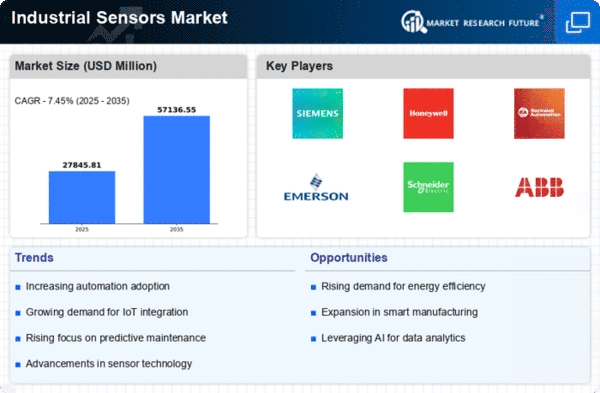

The market dynamics of the industrial sensors market are influenced by several key factors that shape supply, demand, and overall industry trends. One significant driver of this market is the increasing adoption of automation and IoT (Internet of Things) technologies across various industries such as manufacturing, automotive, aerospace, healthcare, and agriculture. As businesses seek to improve operational efficiency, optimize processes, and enhance productivity, there is a growing need for industrial sensors that can monitor, control, and provide real-time data on various parameters such as temperature, pressure, humidity, motion, and chemical composition.

Technological advancements play a crucial role in driving the market dynamics of industrial sensors. As sensor technology continues to evolve and become more advanced, manufacturers are developing sensors with higher accuracy, sensitivity, reliability, and connectivity capabilities. This includes the development of smart sensors with built-in signal processing, wireless communication, and self-diagnostic features, enabling seamless integration with industrial automation systems, data analytics platforms, and cloud-based IoT platforms.

Another factor influencing market dynamics is the increasing focus on predictive maintenance and condition monitoring in industrial applications. By deploying sensors to monitor equipment health, performance, and environmental conditions in real-time, businesses can detect potential issues early, prevent costly downtime, and optimize maintenance schedules to maximize asset uptime and longevity. As industries transition from reactive maintenance practices to proactive and predictive maintenance strategies, there is a growing demand for sensors that can provide accurate and actionable insights into equipment health and performance.

The competitive landscape also plays a significant role in shaping market dynamics. Major players in the industry, including sensor manufacturers, technology companies, and industrial automation providers, compete for market share by offering a wide range of sensors with different features, performance specifications, and price points. Competition among manufacturers drives continuous innovation in sensor design, packaging, materials, and manufacturing processes, benefiting customers with a variety of options to choose from.

Additionally, market dynamics are influenced by regulatory requirements and industry standards. Compliance with regulations such as ISO (International Organization for Standardization) standards, IEC (International Electrotechnical Commission) standards, and safety certifications such as UL (Underwriters Laboratories) and CE (Conformité Européenne) is essential for sensor manufacturers to ensure product quality, safety, and legal compliance. Adherence to industry standards also facilitates interoperability and compatibility between different sensors and industrial automation systems.

Economic factors also impact the market dynamics of industrial sensors. Budget constraints, cost considerations, and return on investment (ROI) calculations may influence purchasing decisions among businesses, especially in industries facing financial challenges or market uncertainties. Sensor manufacturers may offer flexible pricing models, volume discounts, and customized solutions to accommodate the budgetary needs of their customers and drive adoption of their products.

Furthermore, market dynamics are shaped by emerging trends and technologies in the industrial sensors industry. Trends such as the rise of edge computing, AI (Artificial Intelligence), and machine learning are driving demand for intelligent sensors that can analyze data locally, make real-time decisions, and provide actionable insights without relying on centralized processing or cloud connectivity. Other trends, such as the integration of sensors with industrial robotics, drones, and autonomous vehicles, are reshaping the capabilities of industrial automation systems and enabling new applications in areas such as smart factories, logistics, and agriculture.

Leave a Comment