Market Share

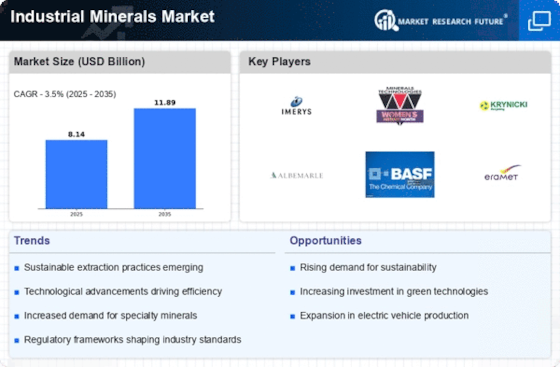

Industrial Minerals Market Share Analysis

In the diverse and expansive landscape of the Industrial Minerals market, companies employ a variety of strategies to establish and fortify their market share positioning. One fundamental approach is differentiation, where companies strive to set their industrial minerals apart from competitors by offering unique compositions, quality standards, or applications across various industries. This might involve innovations in extraction and processing techniques for improved purity, specialized grading, or tailored solutions for specific industrial needs. Through differentiation, companies attract buyers and industries seeking distinctive industrial minerals, enabling them to secure a distinctive market share within the Industrial Minerals industry.

Cost leadership is another prevalent strategy in this market, where companies aim to become the low-cost providers of industrial minerals. This involves optimizing extraction, processing, and supply chain processes to reduce costs without compromising on quality. Cost leadership is effective in appealing to cost-conscious industries, particularly those requiring bulk volumes of minerals for manufacturing processes. However, maintaining high-quality standards and consistent supply is crucial to ensure customer satisfaction and loyalty in this cost-driven strategy.

Market segmentation is widely adopted in the Industrial Minerals industry. Companies analyze the diverse needs of their customer base, which includes sectors such as construction, manufacturing, and agriculture, and develop specialized mineral products tailored for specific market segments. For instance, they might focus on supplying minerals for soil amendments in agriculture or minerals with specific chemical properties for industrial manufacturing. By addressing the unique requirements of each segment, companies can establish a robust presence within different markets, contributing to an overall enhanced market share.

Strategic partnerships and collaborations play a pivotal role in the Industrial Minerals market. Companies often form alliances with end-users, research institutions, or distributors to strengthen their distribution networks, enhance brand visibility, and expand market reach. Collaborative efforts can lead to shared resources, access to new technologies, and entry into new geographic markets. Through strategic partnerships, companies can navigate industry challenges more effectively, ultimately contributing to a more secure market share position.

Innovation stands as a cornerstone strategy in the Industrial Minerals market, driven by the continual pursuit of improved extraction methods, product applications, and sustainability practices. Companies invest in research and development to introduce mineral formulations with enhanced properties, reduced environmental impact, or innovative applications in emerging industries. Innovations in recycling industrial minerals, developing eco-friendly processing methods, or creating minerals with specific characteristics contribute to staying competitive and attracting buyers seeking sustainable and versatile mineral solutions. By being at the forefront of innovation, companies position themselves as leaders in the Industrial Minerals market, securing a significant market share.

Customer-centric strategies are gaining prominence as companies recognize the importance of providing exceptional customer experiences. This involves offering technical support, customization options, and responsive customer service. Exceptional customer service contributes to satisfaction and loyalty, encouraging industries to choose a particular brand for their industrial mineral needs. By focusing on building strong relationships with customers, companies can solidify their market share and maintain a competitive edge in the Industrial Minerals industry.

Leave a Comment