Market Analysis

In-depth Analysis of Industrial Minerals Market Industry Landscape

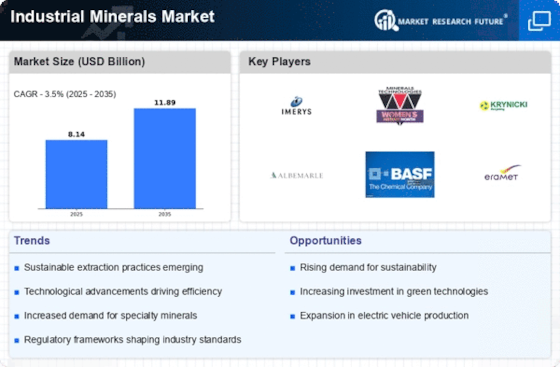

The market dynamics of industrial minerals are influenced by a diverse range of factors that shape the supply, demand, and overall trends within various industrial sectors. Industrial minerals encompass a broad category of non-metallic minerals used in numerous applications, including construction, manufacturing, agriculture, and technology. Understanding the market dynamics involves examining elements such as economic conditions, technological advancements, sustainability considerations, regulatory impacts, and competitive forces.

Economic conditions play a pivotal role in the market dynamics of industrial minerals. The demand for industrial minerals is closely tied to overall economic activity, as these minerals are essential components in the production of goods and infrastructure. During periods of economic growth, there is typically increased demand for industrial minerals in construction, manufacturing, and other industries. Conversely, economic downturns can lead to reduced demand as industrial activities slow down. The cyclical nature of industrial minerals demand makes economic conditions a primary driver in shaping market dynamics.

Technological advancements are key drivers in the market dynamics of industrial minerals. Innovations in extraction techniques, processing methods, and applications contribute to increased efficiency, reduced environmental impact, and the development of new uses for industrial minerals. Advanced technologies play a role in enhancing the properties of industrial minerals, making them more suitable for specific applications. Companies that invest in and adopt cutting-edge technologies gain a competitive advantage by offering high-quality industrial minerals that meet the evolving needs of industries.

Sustainability considerations are increasingly shaping the market dynamics of industrial minerals. As industries prioritize eco-friendly practices, there is a growing demand for responsibly sourced and processed industrial minerals. Sustainable mining practices, waste reduction efforts, and the use of recycled or alternative materials contribute to the industry's ability to meet the demands of environmentally conscious consumers and comply with evolving environmental regulations. Companies that embrace sustainability practices position themselves favorably in a market that values environmental responsibility.

Regulatory impacts, including safety standards and environmental regulations, significantly influence the market dynamics of industrial minerals. Compliance with regulations related to mining operations, workplace safety, and environmental impact is essential for manufacturers to ensure product acceptance and adherence to legal requirements. Changes in regulatory standards can influence the way industrial minerals are extracted, processed, and used in various applications. Staying informed about evolving regulations is crucial for companies to navigate the complex landscape of industrial minerals.

Industry applications significantly impact the market dynamics of industrial minerals. The demand for industrial minerals is diverse, with applications ranging from construction materials to ceramics, glass, agriculture, and electronics. The growth of industries such as renewable energy, electric vehicles, and advanced manufacturing further contributes to the demand for specific industrial minerals. Manufacturers must stay attuned to industry applications and technological advancements to align their product offerings with the diverse needs of users in different sectors.

Competitive forces are a significant aspect influencing the market dynamics of industrial minerals. The industry is marked by competition among mining companies, processors, and manufacturers, each vying for market share. Differentiation through product quality, consistency, and sustainability practices becomes crucial for companies to maintain a competitive edge in the dynamic industrial minerals market. The ability to adapt to changing market conditions, emerging technologies, and customer demands is essential for success.

Global considerations, including trade dynamics and regional preferences, also impact the market for industrial minerals. Manufacturers may need to navigate varying regulations, trade agreements, and industry practices across different regions. Adapting to market dynamics in different parts of the world is crucial for companies aiming to establish a strong and sustainable presence in the global industrial minerals market.

Leave a Comment