North America : Market Leader in Fermentation

North America is poised to maintain its leadership in the Industrial Fermentation Chemicals Market, holding a significant market share of $38,400M in 2024. The region's growth is driven by increasing demand for bio-based chemicals, stringent environmental regulations, and advancements in fermentation technology. The push for sustainable practices and renewable resources further catalyzes market expansion, making it a hub for innovation in the sector.

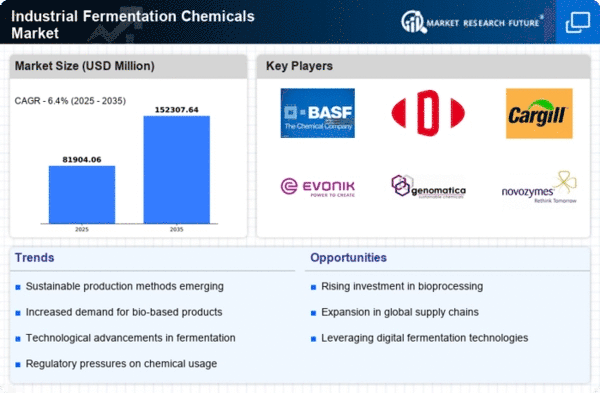

The United States stands out as the leading country, hosting major players like DuPont, Cargill, and BASF. The competitive landscape is characterized by significant investments in R&D and strategic partnerships aimed at enhancing production efficiency. The presence of established companies and a robust supply chain infrastructure solidify North America's position as a key player in the global market.

Europe : Emerging Market with Potential

Europe is witnessing a burgeoning Industrial Fermentation Chemicals Market, valued at $23,000M in 2024. The region's growth is fueled by increasing consumer demand for sustainable products and stringent EU regulations promoting green chemistry. Initiatives aimed at reducing carbon footprints and enhancing resource efficiency are pivotal in driving market dynamics, positioning Europe as a leader in sustainable industrial practices.

Germany and France are at the forefront, with a strong presence of key players like BASF and Evonik. The competitive landscape is marked by innovation and collaboration among companies to develop advanced fermentation technologies. The European market is also supported by government initiatives that encourage research and development in bio-based chemicals, enhancing its attractiveness for investment.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is rapidly emerging as a significant player in the Industrial Fermentation Chemicals Market, with a market size of $13,000M in 2024. The region's growth is driven by rising industrialization, increasing demand for biofuels, and government initiatives promoting sustainable practices. The shift towards eco-friendly production methods is expected to further boost market growth, making Asia-Pacific a focal point for investment in fermentation technologies.

China and India are leading the charge, with substantial investments in biotechnology and fermentation processes. The competitive landscape features both local and international players, including Genomatica and Novozymes, who are actively expanding their operations. The region's diverse market dynamics and growing consumer awareness about sustainability are key factors contributing to its rapid growth in the sector.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa represent an emerging market for Industrial Fermentation Chemicals, with a market size of $5,777.5M in 2024. The region's growth is driven by increasing investments in biotechnology and a rising demand for sustainable chemicals. Government initiatives aimed at diversifying economies and promoting industrial growth are pivotal in shaping the market landscape, creating opportunities for fermentation technologies.

Countries like South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing production capabilities. As the region continues to develop its industrial base, the demand for fermentation chemicals is expected to rise significantly, positioning it as a key player in the global market.