Fermentation Chemicals Market Summary

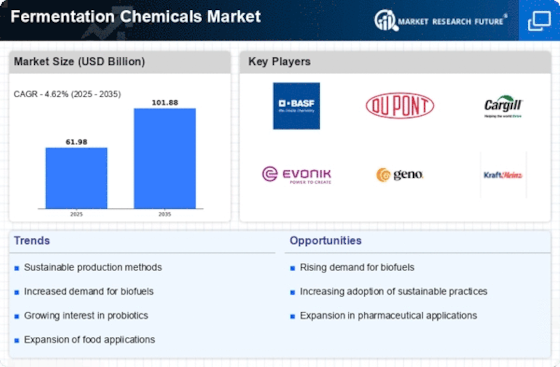

As per Market Research Future analysis, the Fermentation Chemicals Market Size was estimated at 61.98 USD Billion in 2024. The fermentation chemicals industry is projected to grow from 64.84 USD Billion in 2025 to 101.88 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.62% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Fermentation Chemicals Market is poised for robust growth driven by sustainability and health trends.

- The market is increasingly oriented towards sustainability, with a notable emphasis on biodegradable products.

- Natural ingredient demand is surging, particularly in the Food and Beverages segment, which remains the largest market.

- Technological advancements in fermentation processes are enhancing production efficiency and product quality.

- Rising demand for biodegradable products and the expansion of the Food and Beverage sector are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 61.98 (USD Billion) |

| 2035 Market Size | 101.88 (USD Billion) |

| CAGR (2025 - 2035) | 4.62% |

Major Players

BASF (DE), DuPont (US), Cargill (US), Evonik Industries (DE), Genomatica (US), Kraft Heinz (US), Novozymes (DK), DSM (NL), Ajinomoto (JP), Lonza (CH)