Rising Demand for Efficiency

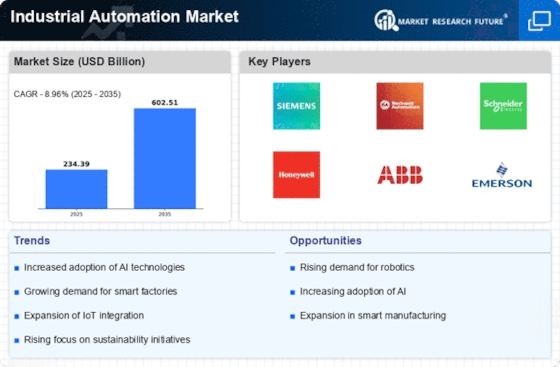

The Industrial Automation Market is experiencing a notable surge in demand for enhanced operational efficiency. Companies are increasingly adopting automation technologies to streamline processes, reduce waste, and improve productivity. According to recent data, organizations that implement automation can achieve efficiency gains of up to 30%. This trend is driven by the need to remain competitive in a rapidly evolving market landscape. As industries strive to optimize their operations, the integration of automation solutions becomes paramount. The Industrial Automation Market is thus positioned to benefit from this growing emphasis on efficiency, as businesses seek to leverage technology to achieve their operational goals.

Increased Focus on Sustainability

Sustainability has emerged as a critical driver within the Industrial Automation Market. Companies are increasingly prioritizing eco-friendly practices and energy-efficient technologies to meet regulatory requirements and consumer expectations. The integration of automation solutions can significantly reduce energy consumption and waste generation, aligning with sustainability goals. Recent studies suggest that automation can lead to a 25% reduction in energy usage in manufacturing processes. As organizations strive to enhance their environmental performance, the Industrial Automation Market is likely to see a surge in demand for sustainable automation solutions that contribute to a greener future.

Growing Need for Skilled Workforce

The Industrial Automation Market faces a growing need for a skilled workforce capable of managing advanced automation technologies. As industries adopt more sophisticated automation solutions, the demand for professionals with expertise in robotics, data analytics, and system integration is increasing. Reports indicate that the skills gap in the automation sector could hinder growth, with an estimated 2 million jobs unfilled by 2025. This situation presents both a challenge and an opportunity for the Industrial Automation Market, as companies invest in training and development programs to equip their workforce with the necessary skills to thrive in an automated environment.

Advancements in Robotics Technology

The Industrial Automation Market is witnessing significant advancements in robotics technology, which are reshaping manufacturing processes. Innovations in robotic systems, such as collaborative robots and autonomous mobile robots, are enhancing flexibility and precision in production lines. Data indicates that the adoption of robotics in manufacturing can lead to a 20% increase in production rates. As industries recognize the potential of robotics to improve quality and reduce labor costs, the demand for these technologies is expected to rise. This trend underscores the importance of robotics in the Industrial Automation Market, as companies seek to harness these advancements to drive growth and innovation.

Integration of Internet of Things (IoT)

The Industrial Automation Market is being transformed by the integration of the Internet of Things (IoT). IoT technologies enable real-time data collection and analysis, facilitating smarter decision-making and predictive maintenance. This connectivity allows for enhanced monitoring of equipment and processes, leading to reduced downtime and increased operational efficiency. Data shows that IoT adoption in industrial settings can improve productivity by up to 15%. As industries recognize the value of IoT in optimizing operations, the Industrial Automation Market is poised for growth, driven by the demand for interconnected systems that enhance overall performance.