Industrial Automation Size

Industrial Automation Market Growth Projections and Opportunities

Adapting to modern technology is crucial for manufacturers to stay competitive in today's business landscape. A large portion of older manufacturing equipment operates manually and lacks connectivity, making it disjointed in the production process. To meet the demands of consumers, industrial manufacturers are increasingly focused on enhancing efficiency by cutting costs and automating tasks. They're turning to industrial automation solutions to modernize their conventional manufacturing processes, using computer-controlled devices to manage industrial operations.

Integrated computer-controlled devices, control systems, sensors, and artificial intelligence play a pivotal role in industrial automation for manufacturers and service lines. This technology ecosystem enables a connection between various products and components within the plant, enabling complete control over these elements and the ability to automate operations according to schedules. Manufacturers can also track, monitor, and collect data about their plant assets through industrial automation. By integrating operational equipment, manufacturers can gain new insights into patterns and efficiencies as more data is collected from sensors. Thanks to advancements in sensor technology and machine learning, computers can analyze a continuous stream of data, detecting potential asset failures and suggesting solutions.

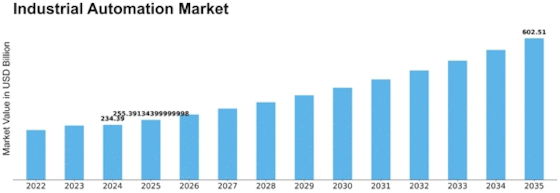

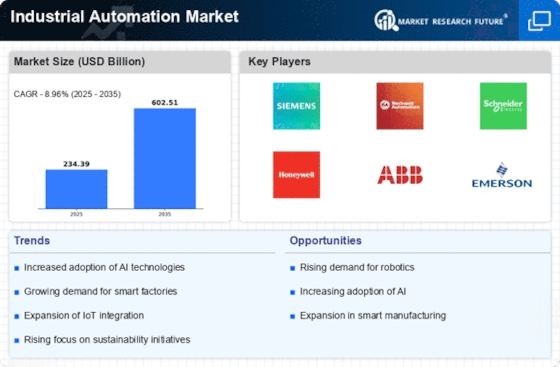

According to MRFR, the global industrial automation market has experienced substantial growth in recent years and is projected to reach USD 414.48 billion by 2030, with a projected Compound Annual Growth Rate (CAGR) of 10.0% during the forecast period from 2022 to 2030.

This market is anticipated to grow at a 10.0% CAGR during the forecast period, 2022-2030. Asia-Pacific led the market in 2021, holding a share of 43.74%, followed by Europe (26.56%) and North America (21.42%). The surge in demand for collaborative robots in manufacturing facilities and the increased need for qualitative and reliable manufacturing processes are driving the growth of the Asia-Pacific region in industrial automation.

The global industrial automation market is categorized based on type, component, solution, industry, and region. Fixed automation held the largest market share in the type segment in 2021, valued at USD 86.22 billion and projected to grow at a CAGR of 9.6% during the forecast period. Regarding components, hardware dominated with a market value of USD 91.36 billion in 2021, expected to grow at a CAGR of 7.8%. In solutions, Human Machine Interface (HMI) held a market value of USD 29.31 billion in 2021, projected to grow at a CAGR of 11.9%. Automotive emerged as the dominant industry with a market value of USD 16.38 billion in 2021 and a projected growth rate of 14.9% during the forecasted period.

Leave a Comment