Rising Urbanization

The rapid urbanization in Indonesia is a key driver for the instant noodles market. As more individuals migrate to urban areas, the demand for convenient and quick meal options increases. Urban lifestyles often lead to busier schedules, making instant noodles an attractive choice for consumers seeking fast and easy meals. In 2025, urban areas in Indonesia are projected to house over 56% of the population, which correlates with a growing preference for ready-to-eat food products. This trend indicates that the instant noodles market is likely to expand as urban dwellers prioritize convenience in their dietary choices.

Cultural Preferences

Cultural factors significantly influence the instant noodles market in Indonesia. The local cuisine's rich flavors and diverse ingredients have led to a strong preference for instant noodles that cater to these tastes. Traditional flavors such as chicken, beef, and spicy variants resonate well with Indonesian consumers. The market is characterized by a variety of local brands that offer unique flavors, appealing to regional preferences. This cultural affinity for instant noodles suggests that the market will likely maintain robust growth as manufacturers continue to innovate and align their products with local tastes.

Innovative Packaging Solutions

Innovative packaging solutions are emerging as a significant driver in the instant noodles market in Indonesia. As consumers become more environmentally conscious, brands are exploring sustainable packaging options. Biodegradable and recyclable materials are gaining traction, appealing to a growing segment of eco-aware consumers. Additionally, convenient packaging that enhances portability and ease of use is becoming increasingly popular. In 2025, the market is likely to see a shift towards packaging that not only preserves product quality but also aligns with consumer values regarding sustainability. This trend may positively impact brand loyalty and market growth.

Increased Distribution Channels

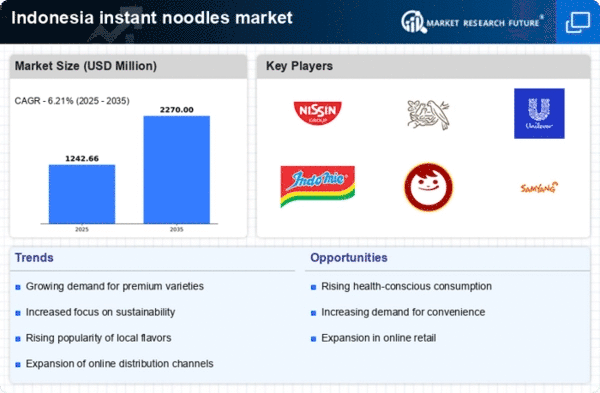

The expansion of distribution channels is a vital driver for the instant noodles market in Indonesia. With the rise of e-commerce and modern retail formats, instant noodles are becoming increasingly accessible to consumers. Supermarkets, convenience stores, and online platforms are enhancing the availability of these products. In 2025, it is anticipated that the penetration of e-commerce will further boost sales, as consumers prefer the convenience of online shopping. This trend indicates that the instant noodles market will benefit from improved distribution strategies, making it easier for consumers to purchase their preferred products.

Affordability and Economic Factors

Affordability plays a crucial role in the instant noodles market in Indonesia. With a significant portion of the population being price-sensitive, instant noodles offer a cost-effective meal solution. The average price of a pack of instant noodles is around 2,000 IDR, making it accessible to a wide demographic. Economic fluctuations can influence consumer spending habits, but the low price point of instant noodles ensures steady demand. In 2025, it is estimated that the instant noodles market will continue to thrive, driven by the economic landscape that favors affordable food options.