Youth Demographics

India's youthful population is a significant driver for the instant noodles market. With approximately 50% of the population under the age of 25, this demographic is more inclined towards fast and convenient food options. The instant noodles market is particularly appealing to students and young professionals who often seek quick meal solutions due to their busy lifestyles. This age group tends to favor products that are easy to prepare and consume, making instant noodles a popular choice. Furthermore, marketing strategies targeting this demographic, such as social media campaigns and influencer partnerships, are likely to enhance brand visibility and attract younger consumers. The trend of snacking and on-the-go meals among youth could further solidify the position of instant noodles in the market.

Rising Urbanization

The rapid urbanization in India is a pivotal driver for the instant noodles market. As more individuals migrate to urban areas, the demand for convenient food options increases. Urban lifestyles often lead to busy schedules, making instant noodles an appealing choice for quick meals. According to recent data, urban areas in India are projected to account for over 35% of the population by 2025, which could significantly boost the instant noodles market. This demographic shift indicates a growing consumer base that prioritizes convenience and speed in meal preparation. Furthermore, the availability of instant noodles in urban retail outlets enhances accessibility, further propelling market growth. The instant noodles market is likely to benefit from this trend as manufacturers adapt their offerings to cater to the preferences of urban consumers.

Diverse Flavor Preferences

The diverse culinary landscape of India plays a vital role in shaping the instant noodles market. Consumers in India exhibit a strong preference for varied flavors, which encourages manufacturers to innovate and expand their product lines. The instant noodles market is witnessing an influx of regional flavors that cater to local tastes, such as masala, curry, and spicy variants. This trend not only attracts a broader consumer base but also fosters brand loyalty as customers seek products that resonate with their cultural preferences. Market data indicates that flavor innovation can lead to a potential increase in sales by up to 20% as consumers are drawn to unique and exciting offerings. As a result, companies are likely to invest in research and development to create new flavors that appeal to the diverse Indian palate.

Increasing Disposable Income

The rise in disposable income among Indian consumers is another crucial driver for the instant noodles market. As economic conditions improve, more households have the financial capacity to purchase convenience foods. Data suggests that the middle-class segment in India is expanding, with an estimated growth rate of 10% annually. This increase in disposable income allows consumers to spend on products that offer convenience and variety, such as instant noodles. The instant noodles market is likely to see a surge in demand as consumers seek affordable yet satisfying meal options. Additionally, the willingness to experiment with different flavors and brands may further enhance market dynamics, as consumers are more inclined to try new products when their financial situation allows.

Growing Online Retail Channels

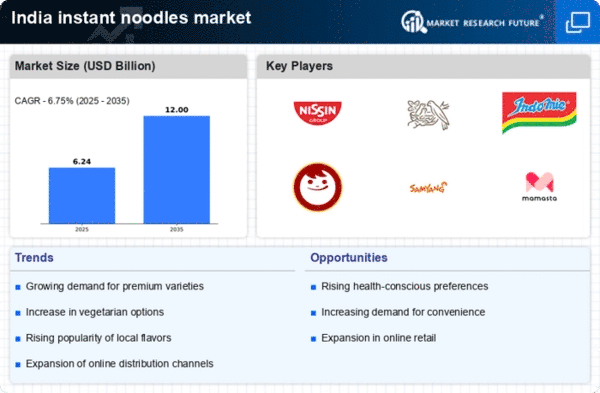

The expansion of online retail channels is transforming the instant noodles market in India. With the increasing penetration of the internet and smartphone usage, consumers are increasingly turning to e-commerce platforms for their grocery needs. This shift is particularly evident among younger consumers who prefer the convenience of online shopping. Data shows that online grocery sales in India are expected to grow by over 30% annually, which could significantly impact the instant noodles market. The instant noodles market stands to benefit from this trend as brands enhance their online presence and offer exclusive deals to attract consumers. Additionally, the ability to compare prices and read reviews online may encourage more consumers to try different brands, further stimulating market growth.