Focus on Sustainability

Sustainability is emerging as a key driver in the Indonesia Extreme Ultraviolet Euv Lithography Market. As global awareness of environmental issues increases, semiconductor manufacturers in Indonesia are likely to adopt more sustainable practices in their production processes. This shift may involve the implementation of energy-efficient lithography systems and the reduction of hazardous materials used in manufacturing. The Indonesian government has also indicated a commitment to promoting green technologies, which could further incentivize companies to invest in sustainable EUV lithography solutions. By aligning with global sustainability trends, the Indonesia Extreme Ultraviolet Euv Lithography Market may attract investment and enhance its reputation on the international stage.

Government Initiatives and Support

The Indonesian government has been actively promoting the development of advanced manufacturing technologies, including the Indonesia Extreme Ultraviolet Euv Lithography Market. This support is evident through various initiatives aimed at enhancing the semiconductor ecosystem within the country. For instance, the government has allocated substantial funding to research institutions and universities to foster innovation in lithography technologies. Additionally, policies that encourage foreign direct investment in semiconductor manufacturing are likely to bolster the local market. As a result, the Indonesia Extreme Ultraviolet Euv Lithography Market is expected to benefit from increased governmental backing, which may lead to a more robust infrastructure and a skilled workforce, ultimately enhancing the competitiveness of local manufacturers.

Collaborative Research and Development

Collaboration between academia, industry, and government entities is becoming increasingly vital for the growth of the Indonesia Extreme Ultraviolet Euv Lithography Market. Joint research initiatives are being established to address the technical challenges associated with EUV lithography. For example, partnerships between local universities and international semiconductor firms could facilitate knowledge transfer and technology sharing. This collaborative approach may lead to the development of innovative solutions tailored to the specific needs of the Indonesian market. Furthermore, the establishment of research centers dedicated to EUV technology could enhance the capabilities of local firms, positioning them favorably within the global semiconductor supply chain.

Rising Demand for Advanced Semiconductors

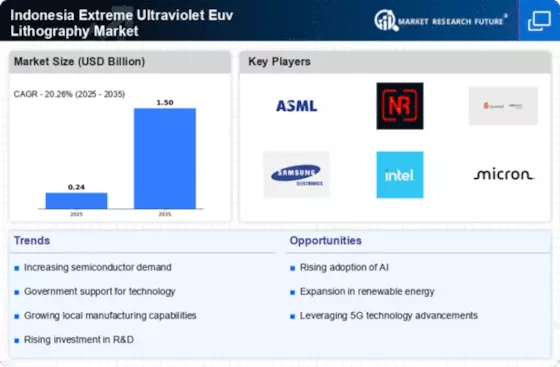

The demand for advanced semiconductors in Indonesia is on the rise, driven by the increasing adoption of digital technologies across various sectors. The Indonesia Extreme Ultraviolet Euv Lithography Market is poised to benefit from this trend, as EUV lithography is essential for producing smaller, more powerful chips. Industries such as telecommunications, automotive, and consumer electronics are expected to drive this demand, with projections indicating a compound annual growth rate (CAGR) of over 10% in the semiconductor sector. As local manufacturers ramp up production to meet this demand, the Indonesia Extreme Ultraviolet Euv Lithography Market is likely to experience significant growth, attracting investments and fostering innovation.

Technological Advancements in Lithography

Technological advancements in lithography are playing a crucial role in shaping the Indonesia Extreme Ultraviolet Euv Lithography Market. Innovations in EUV technology, such as improved light sources and mask designs, are enabling manufacturers to produce chips with higher precision and efficiency. These advancements are essential for meeting the increasing demands for smaller and more complex semiconductor devices. As Indonesian companies invest in upgrading their lithography capabilities, they may enhance their competitiveness in the global market. Furthermore, the integration of automation and artificial intelligence in lithography processes could streamline operations, reduce costs, and improve yield rates, thereby benefiting the overall Indonesia Extreme Ultraviolet Euv Lithography Market.