Increased Mobile Data Consumption

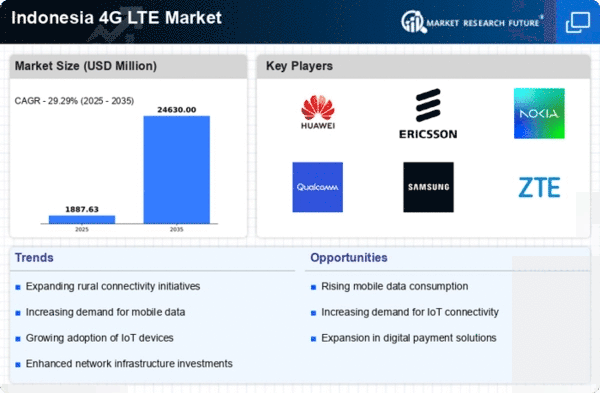

The 4G LTE Market in Indonesia experiences a notable surge in mobile data consumption, driven by the proliferation of smartphones and mobile applications. As of 2025, mobile data traffic in Indonesia is projected to grow at a CAGR of approximately 30%, indicating a robust demand for high-speed internet services. This trend is further fueled by the increasing popularity of streaming services, social media, and online gaming, which require substantial data bandwidth. Consequently, telecommunications providers are compelled to enhance their 4g lte offerings to accommodate this growing appetite for data. The expansion of mobile data consumption not only stimulates competition among service providers but also encourages investments in network infrastructure, thereby propelling the overall growth of the 4G LTE Market in Indonesia.

Rising Demand for IoT Applications

The emergence of the Internet of Things (IoT) presents a transformative opportunity for the 4g lte market in Indonesia. As businesses and consumers increasingly adopt IoT devices, the demand for reliable and fast mobile connectivity intensifies. By 2025, it is anticipated that the number of connected IoT devices in Indonesia will exceed 200 million, necessitating robust 4g lte infrastructure to support seamless communication between devices. This growing ecosystem of connected devices spans various sectors, including agriculture, healthcare, and smart cities, thereby creating diverse applications that rely on mobile networks. Telecommunications providers are likely to capitalize on this trend by enhancing their 4g lte capabilities, ultimately driving growth and innovation within the market.

Urbanization and Connectivity Needs

Rapid urbanization in Indonesia significantly influences the 4g lte market, as more individuals migrate to urban areas seeking better connectivity and access to digital services. By 2025, it is estimated that over 56% of Indonesia's population will reside in urban centers, creating a pressing need for reliable and high-speed internet access. Urban residents increasingly rely on mobile connectivity for various activities, including remote work, e-commerce, and online education. This demographic shift compels telecommunications companies to invest in expanding their 4g lte networks to meet the connectivity demands of urban populations. As a result, the urbanization trend not only drives the adoption of 4g lte services but also fosters innovation in service delivery and customer engagement within the market.

Government Support for Telecommunications Expansion

The Indonesian government plays a pivotal role in fostering the growth of the 4g lte market through supportive policies and initiatives aimed at expanding telecommunications infrastructure. In recent years, the government has launched various programs to enhance digital connectivity across the nation, particularly in underserved regions. By 2025, government investments in telecommunications infrastructure are expected to reach approximately $1 billion, aimed at improving network coverage and quality. This proactive approach not only facilitates the expansion of 4g lte services but also encourages private sector participation in the market. As a result, the collaboration between government and industry stakeholders is likely to enhance the overall competitiveness and accessibility of the 4g lte market in Indonesia.

Technological Advancements in Network Infrastructure

Technological advancements in network infrastructure are significantly shaping the 4g lte market in Indonesia. Innovations such as network virtualization, small cell technology, and advanced antenna systems are enhancing the efficiency and capacity of mobile networks. As of 2025, it is projected that the implementation of these technologies will lead to a 25% increase in network capacity, enabling service providers to accommodate the growing number of users and data traffic. Furthermore, these advancements facilitate improved service quality and reduced latency, which are critical for applications such as video conferencing and online gaming. Consequently, the continuous evolution of network technology is likely to drive the competitiveness and growth of the 4g lte market in Indonesia.