Rising Export Opportunities

The whole milk-powder market in India is poised to benefit from expanding export opportunities. With the global demand for dairy products on the rise, Indian manufacturers are increasingly looking to tap into international markets. The country has the potential to become a significant exporter of whole milk powder, particularly to regions with high consumption rates. Recent data indicates that India's dairy exports have grown by over 15% in the last year, reflecting a strong interest from foreign markets. This trend is likely to continue, driven by competitive pricing and the quality of Indian dairy products. As a result, the whole milk-powder market is expected to see enhanced growth prospects, bolstered by international trade.

Changing Consumer Preferences

Consumer preferences in India are evolving, with a noticeable shift towards convenience and quality in food products. The whole milk-powder market is adapting to these changes by offering products that cater to the modern consumer's lifestyle. There is a growing inclination towards ready-to-use milk powder products, which are perceived as convenient and time-saving. Additionally, consumers are becoming more discerning about the nutritional content of their food, leading to a demand for whole milk powder that is fortified with vitamins and minerals. This shift in consumer behavior is likely to drive innovation and product development within the whole milk-powder market, as companies strive to meet the expectations of health-conscious buyers.

Government Initiatives and Support

The Indian government has been actively promoting the dairy sector through various initiatives aimed at enhancing production and quality. Programs such as the National Dairy Plan and the Dairy Processing and Infrastructure Development Fund are designed to support the whole milk-powder market. These initiatives provide financial assistance and technical support to dairy farmers and processors, encouraging the adoption of modern technologies. As a result, the production of whole milk powder is expected to increase, potentially leading to a more stable supply chain. Furthermore, government policies that focus on improving the livelihoods of dairy farmers are likely to enhance the overall market environment, fostering growth and sustainability in the whole milk-powder market.

Increasing Demand for Dairy Products

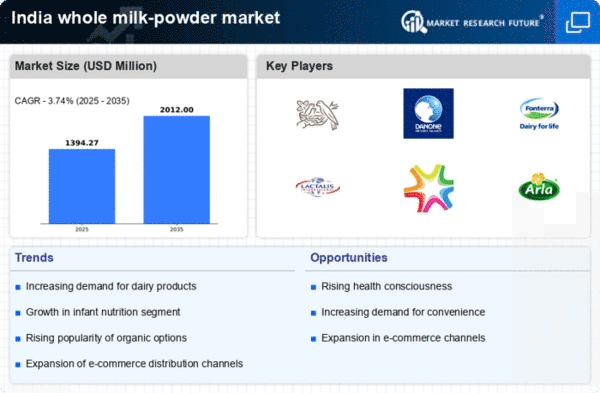

The whole milk-powder market in India is experiencing a notable surge in demand, primarily driven by the increasing consumption of dairy products. As urbanization progresses, more consumers are incorporating dairy into their diets, leading to a projected growth rate of approximately 8% annually. This trend is further supported by the rising popularity of milk-based beverages and snacks, which are becoming staples in many households. The whole milk-powder market is benefiting from this shift, as manufacturers are expanding their production capacities to meet the growing needs of consumers. Additionally, the increasing awareness of the nutritional benefits of dairy, such as calcium and protein content, is likely to sustain this demand, making it a pivotal driver for the market.

Technological Advancements in Production

Technological advancements are playing a crucial role in shaping the whole milk-powder market in India. Innovations in processing techniques, such as spray drying and advanced packaging solutions, are enhancing the quality and shelf life of whole milk powder. These improvements not only meet consumer expectations for quality but also reduce production costs, making it more feasible for manufacturers to scale operations. The adoption of automation and data analytics in production processes is likely to further streamline operations, leading to increased efficiency. As these technologies become more accessible, the whole milk-powder market is expected to experience a transformation, potentially increasing its competitiveness both domestically and internationally.