Rising Cyber Threats

The increasing frequency and sophistication of cyber threats pose a significant challenge to the smart grid security market. In India, the energy sector has witnessed a surge in cyberattacks, prompting utilities to invest heavily in security measures. Reports indicate that the number of cyber incidents targeting critical infrastructure has risen by over 30% in recent years. This alarming trend necessitates the adoption of advanced cybersecurity solutions to protect sensitive data and ensure the reliability of energy supply. As a result, the smart grid-security market is expected to grow substantially, driven by the urgent need for robust security frameworks to mitigate these risks.

Increased Awareness and Training

As the threat landscape evolves, there is a growing recognition of the need for skilled professionals in the smart grid security market. In India, utilities are investing in training programs to enhance the cybersecurity skills of their workforce. This focus on education and awareness is crucial, as human error remains a significant factor in security breaches. Reports suggest that organizations that invest in employee training can reduce the risk of cyber incidents by up to 40%. Consequently, the emphasis on workforce development is likely to drive demand for security solutions, further propelling the growth of the smart grid-security market.

Government Initiatives and Policies

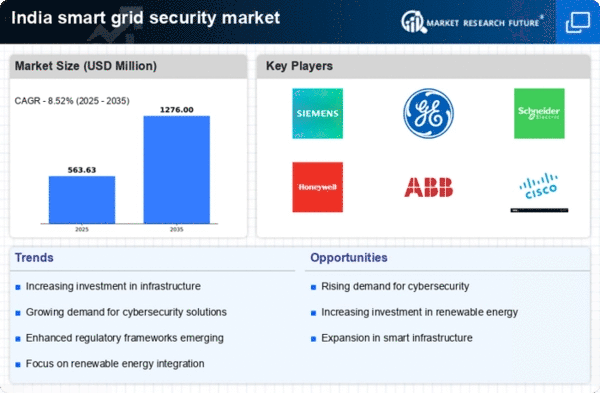

The Indian government has recognized the importance of securing the smart grid infrastructure. It has initiated various policies to bolster cybersecurity. Programs aimed at enhancing the resilience of critical infrastructure are being implemented, with a focus on public-private partnerships. The government has allocated approximately $1 billion for cybersecurity initiatives in the energy sector, which is expected to stimulate growth in the smart grid-security market. These initiatives not only aim to protect against cyber threats but also promote the adoption of innovative technologies that enhance grid security, thereby creating a conducive environment for market expansion.

Growing Demand for Renewable Energy

The transition towards renewable energy sources in India is reshaping the energy landscape. This transition is impacting the smart grid security market. As the share of renewables in the energy mix increases, the complexity of grid management also escalates. This complexity introduces new vulnerabilities that necessitate enhanced security measures. The government aims to achieve 175 GW of renewable energy capacity by 2022, which has likely increased the focus on securing these assets. Consequently, the smart grid-security market is poised for growth as stakeholders seek to implement security solutions that can effectively manage the unique challenges posed by renewable energy integration.

Technological Advancements in Security Solutions

The rapid evolution of technology is driving innovation in the smart grid security market. Emerging technologies such as artificial intelligence (AI), machine learning, and blockchain are being integrated into security solutions to enhance threat detection and response capabilities. In India, the adoption of these advanced technologies is expected to increase as utilities seek to modernize their infrastructure. The market for AI-driven security solutions is projected to grow at a CAGR of 25% over the next five years. This technological advancement not only improves security but also optimizes operational efficiency, making it a key driver for the smart grid-security market.