Rising Cyber Threats

The increasing frequency and sophistication of cyber threats pose a substantial challenge to the smart grid security market. In France, the energy sector has witnessed a surge in cyberattacks, prompting stakeholders to prioritize security measures. Reports indicate that the number of cyber incidents targeting critical infrastructure has escalated by over 30% in recent years. This alarming trend necessitates robust security frameworks to protect sensitive data and ensure operational continuity. As a result, investments in advanced cybersecurity technologies are expected to rise significantly, with projections suggesting a market growth of approximately 15% annually. The urgency to safeguard the smart grid infrastructure against potential breaches is driving innovation and adoption of cutting-edge security solutions within the smart grid security market.

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices within the energy sector is reshaping the smart grid-security market. As France embraces smart technologies, the integration of IoT devices introduces new vulnerabilities that require comprehensive security strategies. It is estimated that the number of connected devices in the energy sector will exceed 1 billion by 2026, amplifying the need for robust security protocols. This surge in connectivity necessitates the implementation of advanced security measures to protect against potential cyber threats. Consequently, the smart grid-security market is likely to experience a paradigm shift, with a focus on developing solutions that address the unique challenges posed by IoT integration. The demand for innovative security frameworks is expected to drive market growth, potentially reaching €1 billion by 2025.

Public Awareness and Education

Growing public awareness regarding cybersecurity risks is influencing the smart grid-security market in France. As consumers become more informed about the potential threats to energy infrastructure, there is an increasing demand for transparency and accountability from energy providers. This heightened awareness is prompting companies to invest in educational initiatives aimed at enhancing cybersecurity practices. Surveys indicate that over 70% of consumers express concern about the security of their energy supply, leading to a push for improved security measures. Consequently, energy providers are likely to prioritize investments in the smart grid-security market to address consumer concerns and build trust. This trend underscores the importance of fostering a culture of security awareness within the energy sector.

Government Initiatives and Funding

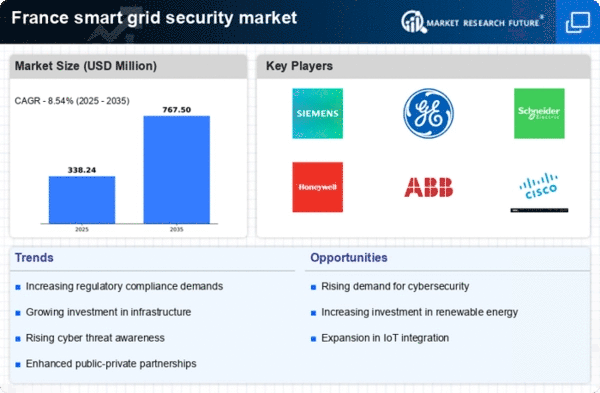

French government initiatives aimed at enhancing energy security are significantly influencing the smart grid-security market. The government has allocated substantial funding to bolster cybersecurity measures across critical infrastructure sectors. Recent reports indicate that public investments in smart grid security are projected to reach €500 million by 2027. These initiatives not only aim to fortify existing systems but also encourage the development of innovative security technologies. The government's commitment to fostering a secure energy landscape is likely to stimulate collaboration between public and private sectors, thereby accelerating advancements in the smart grid-security market. This proactive approach reflects a broader recognition of the importance of safeguarding energy resources against emerging threats.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the smart grid-security market. Innovations in artificial intelligence, machine learning, and blockchain technology are being leveraged to enhance security protocols within the energy sector. These technologies offer the potential to detect and mitigate cyber threats in real-time, thereby improving the resilience of smart grid systems. In France, the adoption of AI-driven security solutions is expected to grow by 20% annually, reflecting the industry's commitment to staying ahead of evolving threats. As energy providers seek to modernize their security frameworks, the integration of advanced technologies is likely to drive significant growth in the smart grid-security market. This trend highlights the necessity for continuous innovation to address the dynamic landscape of cybersecurity challenges.