Government Initiatives and Support

The Indian government plays a pivotal role in fostering the growth of the robot operating-system market through various initiatives and policies. Programs aimed at promoting research and development in robotics and automation are gaining traction. For instance, the 'Make in India' initiative encourages domestic manufacturing of robotic systems, which is expected to enhance the local ecosystem. Financial incentives and grants for startups in the robotics sector are also being introduced, potentially leading to a more vibrant market landscape. The government's focus on smart cities and infrastructure development further propels the demand for robotic solutions, indicating a strong commitment to advancing the robot operating-system market in India.

Technological Advancements in Robotics

Technological advancements significantly influence the robot operating-system market in India. Innovations in artificial intelligence (AI), machine learning, and sensor technologies are enhancing the capabilities of robotic systems. These advancements enable robots to perform complex tasks with greater accuracy and efficiency. The integration of AI into robotic systems is particularly noteworthy, as it allows for improved decision-making and adaptability in dynamic environments. As a result, industries are increasingly adopting these advanced robotic solutions, leading to a projected market growth of 20% over the next five years. This trend underscores the importance of continuous innovation in driving the evolution of the robot operating-system market.

Growing Interest in Collaborative Robots

The rise of collaborative robots, or cobots, is reshaping the landscape of the robot operating-system market in India. Unlike traditional industrial robots, cobots are designed to work alongside human operators, enhancing productivity without the need for extensive safety measures. This trend is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources for large-scale automation. The market for cobots is expected to grow at a rate of 25% annually, driven by their versatility and ease of integration into existing workflows. As businesses recognize the benefits of human-robot collaboration, the demand for suitable operating systems to support these interactions is likely to increase, further propelling the robot operating-system market.

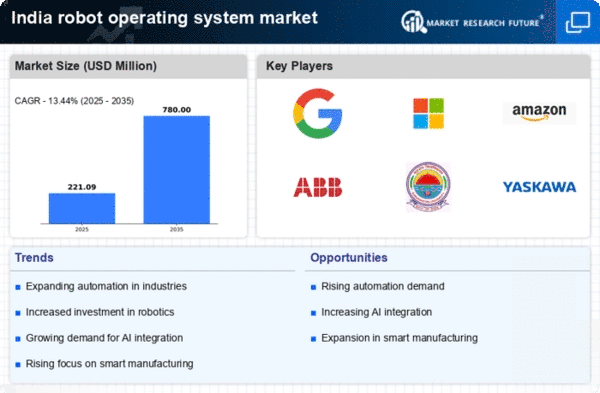

Rising Demand for Automation in Industries

The robot operating system market in India experiences a notable surge in demand for automation across various industries. As companies strive to enhance productivity and reduce operational costs, the integration of robotic systems becomes increasingly appealing. The manufacturing sector, in particular, is witnessing a shift towards automated processes, with an estimated growth rate of 15% annually. This trend is driven by the need for precision and efficiency, which robotic systems can provide. Furthermore, the Indian government promotes initiatives aimed at boosting automation, thereby creating a conducive environment for the robot operating-system market. The increasing adoption of Industry 4.0 principles further accelerates this trend, as businesses seek to leverage advanced technologies to remain competitive.

Increased Focus on Education and Skill Development

The robot operating-system market in India is also influenced by an increased focus on education and skill development in robotics and automation. Educational institutions are incorporating robotics into their curricula, fostering a new generation of skilled professionals. This emphasis on skill development is crucial, as the market requires a workforce adept in operating and programming robotic systems. Government initiatives aimed at enhancing technical education and vocational training are expected to yield a more competent workforce, which in turn supports the growth of the robot operating-system market. As the demand for skilled labor rises, educational programs are likely to evolve, aligning with industry needs and further driving market expansion.