Leading market players are adopting various strategies of expansion and innovation, which will aid the India Perimeter Intrusion Detection and Prevention Market, grow even more. Market players are also adopting various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements among companies with complementary service lines, mergers & acquisitions, investments, & partnerships with other organizations. To expand and survive in a more competitive and rising market climate, India Perimeter Intrusion Detection and Prevention industry must offer cost-effective items.

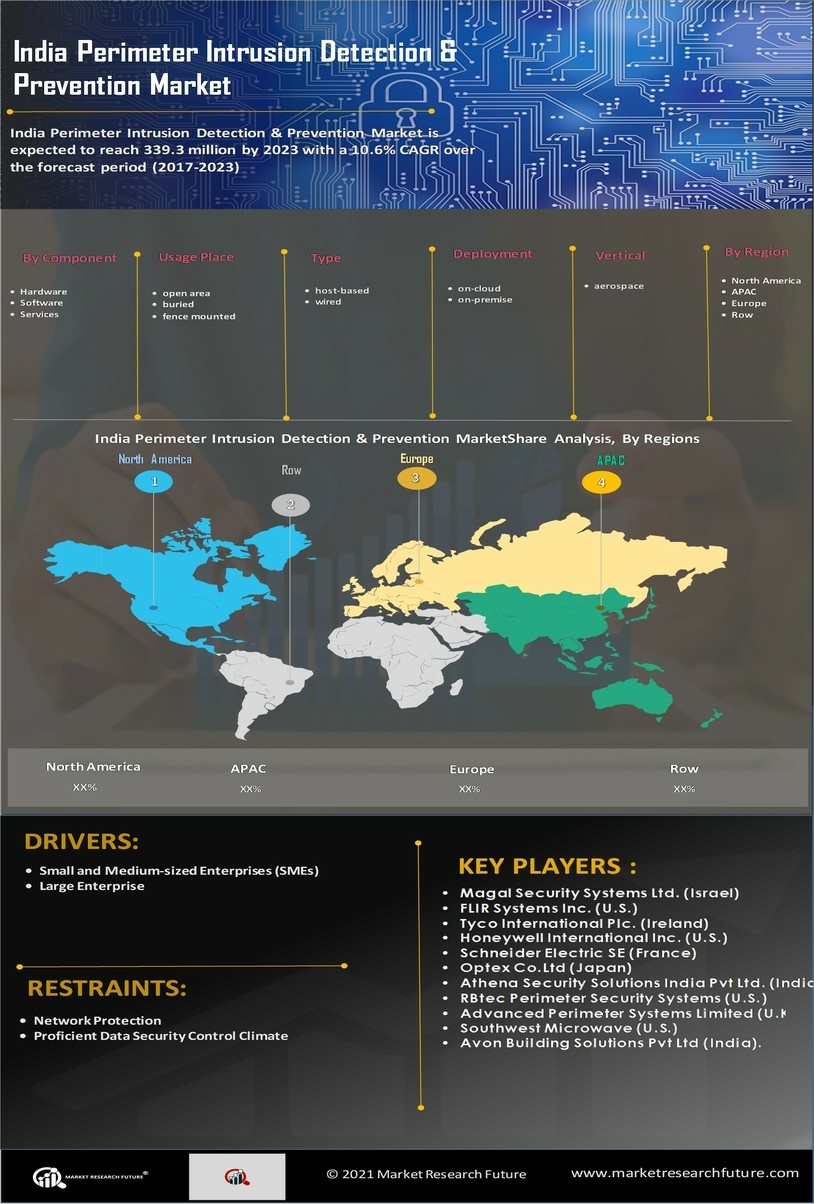

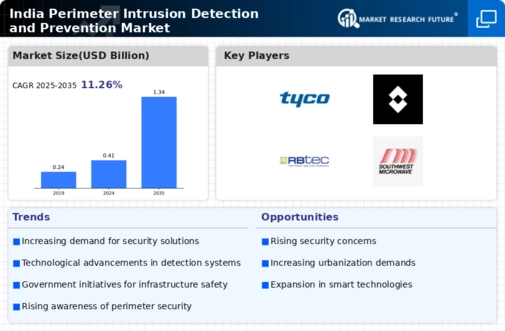

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the India Perimeter Intrusion Detection and Prevention industry to benefit clients and increase the market sector. In recent years, the India Perimeter Intrusion Detection and Prevention industry has offered some of the most significant advantages to medicine. Major players in the India Perimeter Intrusion Detection and Prevention Market, including Magal Security Systems Ltd. (Israel), Tyco International Plc. (Ireland), FLIR Systems Inc. (US), Schneider Electric SE (France), Optex Co. Ltd. (Japan), Athena Security Solutions India Pvt.

Ltd. (India), RBtec Perimeter Security Systems (US), Advanced Perimeter Systems Limited (UK), Honeywell International Inc. (US), Southwest Microwave (US), Avon Building Solutions Pvt. Ltd. (India), and others are attempting increase growth of the market by investing in research and development operations.

Magal Solutions has served as a leading integrator of large-scale, turnkey projects for more than 50 years, offering security, safety, and operational efficiency solutions to the most important and strategic assets of all the world's governments. Magal's offering encompasses design, integration, project management, software development, and sensor engineering with vast experience and a solid foundation in research and development. Magal offers full project life-cycle services. By providing unified solutions that improve its customers' technological and operational capabilities, Magal empowers its clients.

These solutions include access control, video, CCTV, and perimeter intrusion detection systems (PIDS), all of which are fully integrated into the company's robust command and control platform.

In August In August 2020, The Senstar division of Magal Security Systems, Ltd., a supplier of complete physical, video, & access control security products, has been selected to provide equipment to secure deployable military assets used all over the world.

A division of Teledyne technology Inc., Teledyne FLIR LLC (Teledyne FLIR), previously FLIR Systems Inc., is a provider of technology and sensing systems. Advanced thermal imaging, sensor systems, threat detection systems, night vision, and infrared camera systems are all products that the firm creates, develops, markets, and distributes. Additionally, it creates integrated, networked electronic solutions for the maritime industry from stem to stern. The company's cutting-edge image and sensor systems are used in a variety of industries, including government and defense, business, transportation, security, professional tools, maritime, home, and outdoor, as well as research and development.

In September 2021, Elara R-Series Commercial Ground Security Radars and the FH-Series Multispectral Fixed Cameras have been added to Teledyne FLIR's range of perimeter security products for critical infrastructure, according to the company.