Rising Healthcare Expenditure

The increase in healthcare expenditure in India is positively impacting the nasal spray market. As more individuals seek medical attention for various health issues, including allergies and respiratory conditions, the demand for effective treatment options is on the rise. Government initiatives aimed at improving healthcare access and affordability are also contributing to this trend. With healthcare spending projected to grow by approximately 12% annually, the nasal spray market is expected to benefit from increased investments in healthcare infrastructure and services. This growth in expenditure is likely to enhance the availability and accessibility of nasal sprays, further driving market expansion.

Expansion of Distribution Channels

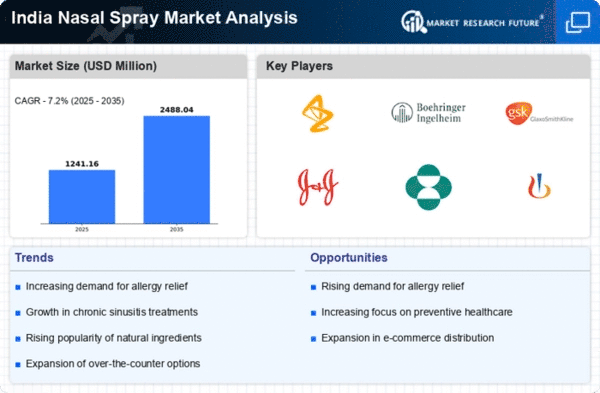

The nasal spray market in India is witnessing a significant transformation due to the expansion of distribution channels. With the rise of e-commerce and online pharmacies, consumers now have easier access to a variety of nasal spray products. This shift is particularly beneficial for those living in remote areas where traditional pharmacies may be limited. Additionally, brick-and-mortar stores are increasingly stocking a wider range of nasal sprays, catering to diverse consumer needs. This enhanced availability is likely to drive market growth, as consumers are more inclined to purchase products that are readily accessible. The market is expected to see a growth rate of around 7% in the coming years, driven by these distribution advancements.

Innovations in Product Formulations

Innovations in product formulations are playing a crucial role in shaping the nasal spray market in India. Manufacturers are investing in research and development to create advanced formulations that enhance the efficacy and user experience of nasal sprays. For instance, the introduction of preservative-free options and formulations with added therapeutic benefits is attracting a broader consumer base. These innovations not only improve patient compliance but also address specific health concerns, such as nasal congestion and sinus pressure. As a result, the market is likely to experience a surge in demand, with an anticipated growth rate of 6-8% over the next few years, driven by these advancements.

Growing Awareness of Self-Medication

The trend of self-medication is gaining popularity in India, particularly among urban populations. Patients are increasingly opting for over-the-counter nasal sprays for quick relief from common ailments such as allergies and sinusitis. This shift is driven by the convenience and accessibility of nasal sprays, which can be purchased without a prescription. The nasal spray market is benefiting from this trend, as consumers seek effective solutions that can be used at home. Market data indicates that the self-medication segment is projected to grow at a rate of 8-10% annually, further solidifying the position of nasal sprays as a go-to option for managing minor health issues.

Increasing Prevalence of Respiratory Disorders

The nasal spray market in India is experiencing growth due to the rising incidence of respiratory disorders such as asthma and allergic rhinitis. According to health reports, approximately 10-15% of the Indian population suffers from these conditions, leading to a heightened demand for effective treatment options. Nasal sprays, known for their rapid action and ease of use, are becoming a preferred choice among patients. This trend is further supported by the increasing awareness of respiratory health and the importance of timely intervention. As healthcare providers recommend nasal sprays for their efficacy, the market is likely to expand, catering to a larger segment of the population seeking relief from respiratory ailments.