Rising Environmental Awareness

Increasing environmental consciousness among consumers is a significant driver for the low speed-vehicle market. As awareness of air pollution and climate change grows, more individuals are seeking sustainable transportation options. Low speed-vehicles, particularly electric variants, are perceived as eco-friendly alternatives that contribute to reducing carbon footprints. Surveys indicate that approximately 70% of urban residents are willing to switch to greener transportation methods, which bodes well for the low speed-vehicle market. This shift in consumer behavior is likely to encourage manufacturers to innovate and expand their offerings, thereby enhancing the overall market landscape. The emphasis on sustainability is expected to shape the future of transportation in India.

Government Incentives and Policies

Government initiatives aimed at promoting electric and low speed-vehicles significantly influence the low speed-vehicle market. Various state and central policies provide financial incentives, such as subsidies and tax exemptions, to encourage the adoption of these vehicles. For instance, the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme has been instrumental in boosting sales. Reports suggest that the market for electric low speed-vehicles could grow by over 30% annually due to these incentives. Additionally, the government's commitment to reducing carbon emissions aligns with the promotion of low speed-vehicles, making them a focal point in India's transportation strategy. This supportive regulatory environment is likely to enhance market growth.

Cost-Effectiveness and Affordability

The cost-effectiveness of low speed-vehicles is a compelling driver for their market growth in India. With rising fuel prices and the economic burden of traditional vehicles, consumers are increasingly looking for affordable alternatives. Low speed-vehicles typically have lower operational costs, including maintenance and fuel expenses, making them an attractive option for budget-conscious buyers. Data indicates that the total cost of ownership for electric low speed-vehicles can be up to 40% lower than that of conventional vehicles over a five-year period. This financial advantage is likely to encourage more consumers to consider low speed-vehicles as a practical solution for their transportation needs, thereby expanding the market.

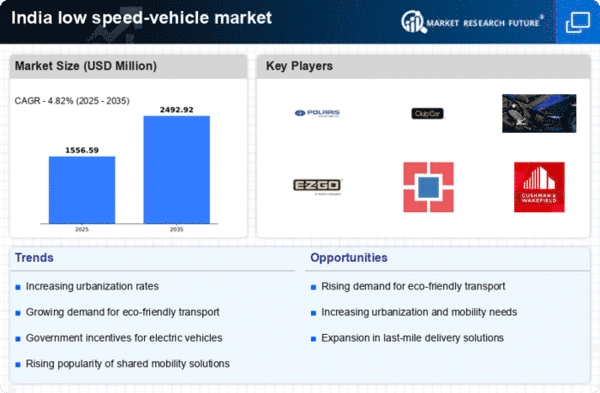

Urbanization and Infrastructure Development

The rapid urbanization in India is a crucial driver for the low speed-vehicle market. As cities expand, the demand for efficient and eco-friendly transportation solutions increases. The government has been investing heavily in infrastructure development, including dedicated lanes for low speed-vehicles, which enhances their usability. In urban areas, where traffic congestion is prevalent, low speed-vehicles offer a practical alternative for short-distance travel. According to recent data, urban areas are projected to account for over 50% of the population by 2030, further propelling the need for low speed-vehicles. This trend indicates a growing acceptance and reliance on these vehicles, making them an integral part of urban mobility solutions in the low speed-vehicle market.

Technological Advancements in Vehicle Design

Technological innovations play a pivotal role in shaping the low speed-vehicle market. Advances in battery technology, lightweight materials, and smart features are enhancing the performance and appeal of these vehicles. For instance, improvements in battery efficiency are extending the range of electric low speed-vehicles, making them more viable for consumers. Additionally, the integration of smart technologies, such as GPS and connectivity features, is attracting tech-savvy buyers. The market is witnessing a surge in demand for vehicles that offer both functionality and modern design. As manufacturers continue to invest in research and development, the low speed-vehicle market is likely to experience a transformation, catering to evolving consumer preferences.