Rising Demand for Automation

The increasing demand for automation across various sectors in India is a pivotal driver for the internet of-things market. Industries such as manufacturing, agriculture, and logistics are increasingly adopting IoT solutions to enhance operational efficiency. For instance, the implementation of IoT in manufacturing has been shown to reduce operational costs by up to 30%. This trend is likely to continue as businesses seek to streamline processes and improve productivity. Furthermore, the Indian government has been promoting initiatives like 'Make in India', which encourages the adoption of advanced technologies, including IoT. As automation becomes more prevalent, the internet of-things market is expected to experience substantial growth, driven by the need for interconnected devices that facilitate seamless operations.

Increased Focus on Data Analytics

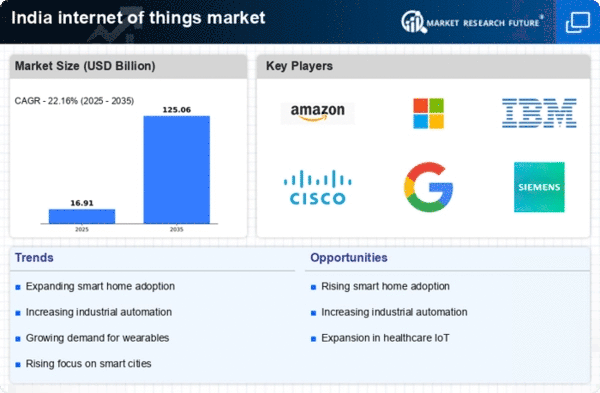

The growing emphasis on data analytics is a significant driver for the internet of-things market in India. As organizations collect vast amounts of data from IoT devices, the need for advanced analytics tools becomes paramount. Businesses are increasingly leveraging data analytics to derive actionable insights, optimize operations, and enhance decision-making processes. For instance, industries such as retail and logistics are utilizing IoT data to improve inventory management and supply chain efficiency. The market for IoT analytics is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of over 25% in the coming years. This focus on data-driven strategies is likely to propel the internet of-things market forward, as companies seek to harness the power of data for competitive advantage.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the internet of-things market in India. Programs such as Digital India and Smart Cities Mission are designed to foster technological advancements and infrastructure development. These initiatives aim to create a conducive environment for IoT adoption by providing funding, resources, and policy support. For example, the Smart Cities Mission has allocated approximately $1.5 billion for the development of smart infrastructure, which includes IoT applications for traffic management, waste management, and energy efficiency. Such government backing not only boosts investor confidence but also encourages local startups to innovate in the IoT space. Consequently, the internet of-things market is likely to flourish as these initiatives gain momentum.

Growing Consumer Electronics Market

The burgeoning consumer electronics market in India significantly contributes to the expansion of the internet of-things market. With an increasing number of households adopting smart devices, the demand for IoT-enabled products is on the rise. Reports indicate that the smart home market in India is projected to reach $10 billion by 2025, driven by the popularity of smart speakers, security systems, and home automation devices. This trend reflects a shift in consumer preferences towards connected devices that offer convenience and enhanced user experiences. As more consumers embrace IoT technologies, the internet of-things market is poised for robust growth, fueled by the integration of smart devices into everyday life.

Advancements in Connectivity Technologies

Advancements in connectivity technologies, such as 5G and LPWAN (Low Power Wide Area Network), are instrumental in propelling the internet of-things market in India. The rollout of 5G networks is expected to enhance data transmission speeds and reduce latency, making it feasible for a larger number of devices to connect simultaneously. This technological evolution is likely to facilitate the deployment of IoT applications across various sectors, including healthcare, agriculture, and transportation. Moreover, LPWAN technologies provide cost-effective solutions for connecting low-power devices, which is essential for applications like smart metering and environmental monitoring. As connectivity improves, the internet of-things market is anticipated to expand, enabling more innovative applications and services.

Leave a Comment