Government Policies and Support

The Indian government has implemented various policies aimed at supporting the agricultural sector, particularly sugarcane farmers, which in turn impacts the industrial sugar market. Initiatives such as minimum support prices (MSP) for sugarcane and subsidies for sugar production are designed to stabilize the market and ensure fair compensation for farmers. As of November 2025, these policies have resulted in a more robust supply chain, enabling the industrial sugar market to maintain consistent production levels. Furthermore, the government's focus on enhancing infrastructure and logistics for sugar distribution is likely to improve market efficiency, thereby benefiting manufacturers and consumers alike.

Health Trends and Sugar Alternatives

The industrial sugar market in India is currently navigating a complex landscape influenced by rising health consciousness among consumers. There is a growing trend towards sugar alternatives and healthier sweeteners, which could potentially impact traditional sugar consumption. However, despite these shifts, industrial sugar remains a staple in many food products. The market is adapting by exploring innovative formulations that incorporate lower sugar content while maintaining taste. This dual approach may allow manufacturers to cater to health-conscious consumers while still capitalizing on the demand for industrial sugar in various applications. The balance between health trends and traditional sugar use presents both challenges and opportunities for the industrial sugar market.

Technological Innovations in Production

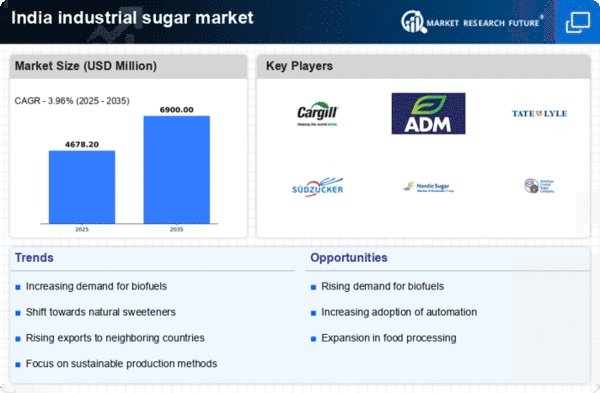

Technological advancements in sugar production processes are playing a crucial role in shaping the industrial sugar market in India. Innovations such as improved extraction techniques and automation in processing facilities are enhancing efficiency and reducing production costs. As of November 2025, many manufacturers are investing in state-of-the-art technology to optimize their operations, which may lead to higher yields and better quality sugar. The industrial sugar market is likely to see a shift towards more sustainable practices as these technologies reduce waste and energy consumption. This focus on innovation not only supports competitiveness but also aligns with global trends towards sustainability in food production.

Rising Demand from Food and Beverage Sector

The food and beverage sector in India is experiencing a notable surge in demand for industrial sugar, driven by changing consumer preferences and an expanding population. As of 2025, the sector accounts for approximately 60% of the total sugar consumption in the country. This increasing demand is likely to propel the industrial sugar market, as manufacturers seek to meet the needs of various products, including soft drinks, confectionery, and baked goods. Furthermore, the trend towards convenience foods and ready-to-eat meals is expected to further boost sugar usage in these applications. The industrial sugar market is thus positioned to benefit from this growing sector, as companies adapt their production strategies to align with consumer trends and preferences.

Export Opportunities and International Trade

India's industrial sugar market is poised to benefit from expanding export opportunities, particularly in regions with high sugar demand. In recent years, India has emerged as one of the leading sugar exporters, with exports reaching approximately 5 million tonnes in 2025. This growth is attributed to favorable pricing and competitive quality, making Indian sugar attractive in international markets. The industrial sugar market is likely to see increased production to cater to this demand, as global markets seek reliable suppliers. Additionally, trade agreements and partnerships with other countries may further enhance export potential, allowing Indian manufacturers to tap into lucrative markets and diversify their revenue streams.