Government Policy Support

Government initiatives play a pivotal role in shaping the gpon technology market in India. The National Digital Communications Policy aims to provide broadband access to all citizens, which aligns with the objectives of the gpon technology market. The government has allocated substantial funds, estimated at $10 billion, to enhance digital infrastructure, particularly in rural areas. This financial backing encourages private sector participation, fostering a competitive environment that benefits consumers. Additionally, regulatory frameworks are being established to streamline the deployment of gpon technology, ensuring that service providers can efficiently expand their networks. As a result, the gpon technology market is likely to witness accelerated growth, driven by supportive government policies and investments.

Rising Demand for Smart Homes

The gpon technology market is significantly influenced by the rising demand for smart home solutions in India. As consumers increasingly seek automation and connectivity within their homes, the need for robust internet infrastructure becomes paramount. The smart home market is projected to grow at a CAGR of 25% over the next five years, creating a substantial opportunity for gpon technology. High-speed internet is essential for the seamless operation of smart devices, including security systems, lighting, and appliances. Consequently, service providers are focusing on deploying gpon technology to meet this demand, thereby enhancing the overall market landscape. The integration of gpon technology into smart home solutions is likely to drive further adoption and innovation within the industry.

Increasing Internet Penetration

The gpon technology market in India is experiencing a notable surge due to the increasing internet penetration across urban and rural areas. As of 2025, internet penetration in India stands at approximately 60%, with projections indicating a rise to 75% by 2027. This growth is driven by the expanding digital landscape, where more individuals and businesses seek reliable and high-speed internet connectivity. The demand for seamless online experiences, including streaming, gaming, and remote work, propels the adoption of gpon technology. Consequently, service providers are investing in infrastructure to meet this demand, thereby enhancing the gpon technology market. The focus on bridging the digital divide further emphasizes the importance of gpon technology in delivering high-speed internet to underserved regions.

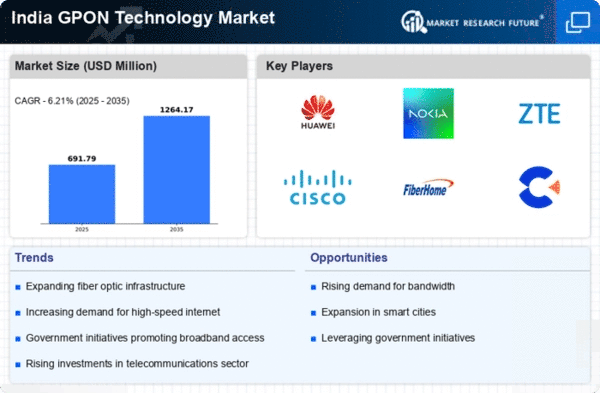

Competitive Landscape and Market Dynamics

The gpon technology market in India is characterized by a dynamic competitive landscape, with numerous players vying for market share. Major telecommunications companies are investing heavily in gpon infrastructure to differentiate their services and attract customers. As of 2025, the market is witnessing a shift towards bundled services, where internet, television, and telephony are offered together, enhancing customer value. This competitive environment encourages innovation and the introduction of advanced gpon solutions, which may lead to improved service quality and customer satisfaction. The ongoing rivalry among service providers is likely to stimulate growth in the gpon technology market, as companies strive to enhance their offerings and expand their reach.

Technological Advancements in Fiber Optics

Technological advancements in fiber optics are significantly impacting the gpon technology market in India. Innovations in fiber optic materials and manufacturing processes have led to the development of more efficient and cost-effective solutions. As of 2025, the introduction of next-generation fiber optics is expected to enhance data transmission speeds and reduce latency, making gpon technology even more attractive to service providers. These advancements not only improve the performance of existing networks but also facilitate the deployment of new gpon infrastructure. The continuous evolution of fiber optic technology is likely to drive the growth of the gpon technology market, as providers seek to leverage these innovations to meet the increasing demands for high-speed internet.