Focus on Indigenous Manufacturing

The push for indigenous manufacturing in India is a significant driver for the India Extreme Ultraviolet Euv Lithography Market. The government has emphasized the need to reduce dependency on foreign technology and components, which has led to increased investments in local manufacturing facilities. Companies are now focusing on developing Euv lithography systems within India, which not only supports the local economy but also enhances supply chain resilience. This focus on self-sufficiency is expected to create a robust ecosystem for Euv lithography, potentially leading to innovations and cost reductions in the India Extreme Ultraviolet Euv Lithography Market.

Government Initiatives and Support

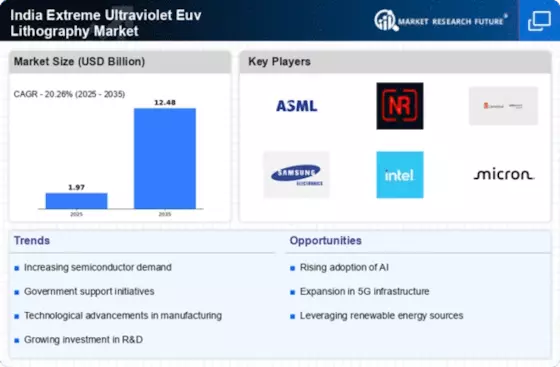

The Indian government has been actively promoting the semiconductor industry, which includes the India Extreme Ultraviolet Euv Lithography Market. Initiatives such as the Production Linked Incentive (PLI) scheme aim to attract investments and boost local manufacturing capabilities. The government has allocated substantial funds to support research and development in advanced lithography technologies. This support is crucial as it encourages domestic companies to invest in Euv lithography, which is essential for producing smaller, more efficient chips. The government's commitment to enhancing the semiconductor ecosystem is expected to drive growth in the India Extreme Ultraviolet Euv Lithography Market, potentially leading to a more self-reliant semiconductor supply chain in the country.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the India Extreme Ultraviolet Euv Lithography Market. As the semiconductor landscape evolves, companies are increasingly allocating resources to R&D to develop next-generation lithography technologies. This focus on innovation is essential for maintaining competitiveness in the global market. The Indian government, along with private sector players, is investing in R&D initiatives aimed at advancing Euv lithography capabilities. Such investments are expected to yield breakthroughs that could enhance the efficiency and effectiveness of semiconductor manufacturing processes, thereby driving growth in the India Extreme Ultraviolet Euv Lithography Market.

Collaborations with International Firms

Collaborations between Indian firms and international technology companies are becoming increasingly prevalent in the India Extreme Ultraviolet Euv Lithography Market. These partnerships facilitate knowledge transfer and access to advanced technologies that are critical for Euv lithography. For instance, Indian semiconductor companies are engaging with leading global players to enhance their technological capabilities. Such collaborations not only help in acquiring cutting-edge Euv lithography equipment but also in training local talent. The influx of foreign expertise is likely to accelerate the development of the India Extreme Ultraviolet Euv Lithography Market, positioning India as a competitive player in the global semiconductor landscape.

Rising Demand for Advanced Semiconductor Technologies

The demand for advanced semiconductor technologies in India is on the rise, driven by the increasing adoption of digital technologies across various sectors. The India Extreme Ultraviolet Euv Lithography Market is poised to benefit from this trend, as Euv lithography is essential for producing high-performance chips required for applications such as artificial intelligence, 5G, and the Internet of Things (IoT). As industries seek to enhance their technological capabilities, the need for advanced lithography solutions becomes more pronounced. This growing demand is likely to propel investments in the India Extreme Ultraviolet Euv Lithography Market, fostering innovation and development.