Emergence of Advanced Technologies

The emergence of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly impacting the embedded analytics market in India. These technologies enable organizations to analyze vast amounts of data and derive actionable insights more efficiently. As businesses increasingly adopt AI and ML, the integration of these technologies into embedded analytics solutions becomes essential. This trend is likely to enhance the capabilities of analytics tools, making them more intuitive and user-friendly. Consequently, the embedded analytics market is expected to grow as organizations seek to leverage these advanced technologies to improve their decision-making processes.

Growing Importance of Real-Time Analytics

The growing importance of real-time analytics is driving the embedded analytics market in India. Organizations are increasingly recognizing the need for immediate insights to respond swiftly to market changes and customer demands. This trend is particularly relevant in sectors such as retail and finance, where timely data can influence critical business decisions. As companies strive to remain competitive, the demand for embedded analytics solutions that provide real-time data visualization and reporting is likely to increase. This shift towards real-time analytics is expected to propel the growth of the embedded analytics market, as businesses seek to enhance their responsiveness and agility.

Increased Focus on Operational Efficiency

In the quest for operational efficiency, Indian enterprises are turning to embedded analytics solutions to optimize their processes. By embedding analytics into their existing systems, organizations can monitor performance metrics and identify areas for improvement in real-time. This trend is particularly evident in sectors such as manufacturing and logistics, where efficiency gains can lead to significant cost savings. The embedded analytics market is expected to thrive as companies prioritize data-driven approaches to enhance productivity and reduce operational costs. As businesses seek to streamline their operations, the demand for embedded analytics solutions is likely to rise.

Growth of Digital Transformation Initiatives

Digital transformation initiatives are reshaping the landscape of the embedded analytics market in India. Organizations across various sectors are investing in technology to streamline operations and improve customer engagement. The Indian government has also been promoting digitalization through initiatives like Digital India, which encourages the adoption of advanced technologies. This environment fosters the integration of embedded analytics into business processes, allowing companies to harness real-time data insights. As a result, the embedded analytics market is likely to witness substantial growth, with businesses seeking to enhance their analytical capabilities to support their digital transformation journeys.

Rising Demand for Data-Driven Decision Making

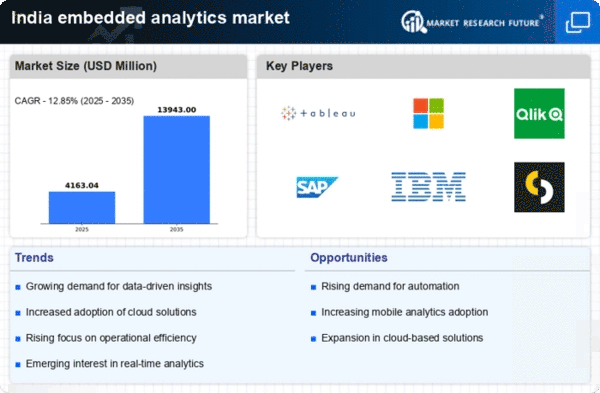

The embedded analytics market in India is experiencing a surge in demand. Organizations increasingly recognize the value of data-driven decision making. Businesses are leveraging analytics to gain insights into customer behavior, operational efficiency, and market trends. According to recent estimates, the analytics market in India is projected to grow at a CAGR of approximately 30% over the next few years. This growth is likely to drive the adoption of embedded analytics solutions, enabling companies to integrate analytical capabilities directly into their applications. As organizations strive to enhance their competitive edge, the embedded analytics market is poised to benefit from this shift towards data-centric strategies.