Increased Focus on Customer Experience

There is an increased focus on enhancing customer experience. Organizations in the GCC are recognizing that providing personalized and data-driven experiences can significantly impact customer satisfaction and loyalty. By integrating analytics into customer-facing applications, businesses can gain insights into customer preferences and behaviors, allowing for more tailored offerings. This trend is supported by the growing availability of customer data and the tools to analyze it effectively. As companies strive to differentiate themselves in a competitive landscape, the demand for embedded analytics solutions that enhance customer experience is likely to rise, further propelling growth in the embedded analytics market.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly impacting the embedded analytics market. Organizations in the GCC are increasingly migrating their operations to the cloud, driven by the need for scalability, flexibility, and cost-effectiveness. Cloud-based analytics solutions offer businesses the ability to access and analyze data from anywhere, facilitating remote work and collaboration. This trend is reflected in the growing number of cloud service providers entering the embedded analytics market, offering tailored solutions to meet the specific needs of GCC businesses. As cloud adoption continues to rise, it is expected that the embedded analytics market will expand, providing organizations with the tools necessary to leverage data effectively in a dynamic business environment.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming critical factors influencing the embedded analytics market. In the GCC, businesses are facing increasing scrutiny regarding data privacy and security regulations. As a result, organizations are investing in embedded analytics solutions that not only provide insights but also ensure compliance with local and international regulations. This focus on governance is likely to drive demand for analytics tools that incorporate robust security features and data management capabilities. Companies that prioritize compliance are expected to gain a competitive edge in the market, as they can assure stakeholders of their commitment to data integrity and security within the embedded analytics market.

Rising Demand for Data-Driven Decision Making

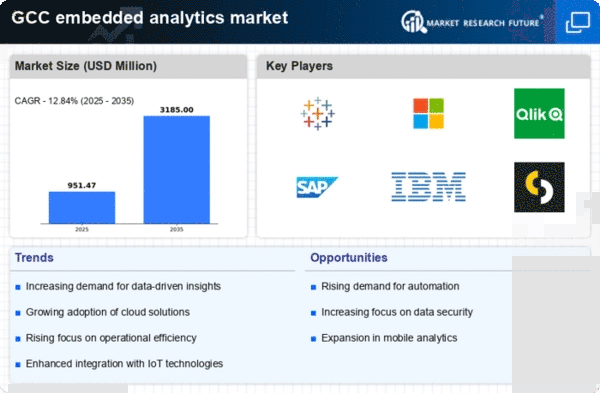

The embedded analytics market is experiencing a surge in demand as organizations in the GCC increasingly prioritize data-driven decision making. This trend is largely influenced by the need for real-time insights that can enhance operational efficiency and strategic planning. According to recent estimates, the market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are recognizing that integrating analytics into their business processes can lead to improved performance and competitive advantage. As a result, investments in embedded analytics solutions are becoming a key focus for businesses aiming to leverage data for informed decision making. This shift is likely to drive innovation and the development of more sophisticated analytics tools within the embedded analytics market.

Technological Advancements in Analytics Tools

Technological advancements are playing a pivotal role in shaping the embedded analytics market. Innovations such as artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of analytics tools, allowing for more sophisticated data analysis and visualization. In the GCC, organizations are increasingly adopting these technologies to gain deeper insights from their data. The integration of AI and ML into embedded analytics solutions is expected to improve predictive analytics, enabling businesses to anticipate market trends and customer behavior more effectively. This technological evolution is likely to attract more investments into the embedded analytics market, as companies seek to harness the power of advanced analytics to drive growth and efficiency.