Advancements in RFID Technology

Technological advancements are driving innovation within the data center-rfid market. The introduction of high-frequency and ultra-high-frequency RFID systems has enhanced data transmission speeds and accuracy. These advancements allow for more efficient tracking and management of assets within data centers. Furthermore, the integration of RFID with artificial intelligence and machine learning is expected to revolutionize data analytics capabilities. As these technologies evolve, they provide organizations with deeper insights into their operations, potentially leading to cost savings and improved efficiency. The continuous evolution of RFID technology is likely to attract more players to the data center-rfid market, fostering a competitive landscape.

Expansion of Cloud Computing Services

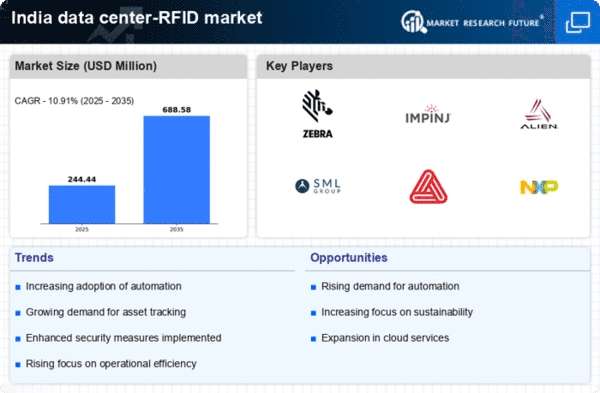

The expansion of cloud computing services in India is creating new opportunities for the data center-rfid market. As more businesses migrate to cloud-based solutions, the need for efficient data management and security becomes critical. RFID technology can facilitate the tracking of physical assets associated with cloud services, ensuring that data centers operate smoothly and securely. Moreover, the integration of RFID with cloud platforms allows for centralized management of assets, enhancing operational efficiency. This trend is likely to drive growth in the data center-rfid market as organizations seek to leverage RFID solutions to support their cloud computing strategies.

Rising Focus on Sustainability Initiatives

Sustainability has become a pivotal concern for businesses in India, influencing the data center-rfid market. Companies are increasingly adopting eco-friendly practices, and RFID technology plays a crucial role in this transition. By enabling better resource utilization and waste reduction, RFID systems contribute to sustainability goals. For instance, RFID can help in monitoring energy consumption and optimizing cooling systems, which are significant contributors to a data center's carbon footprint. As organizations aim to meet regulatory requirements and consumer expectations regarding sustainability, the data center-rfid market is likely to see increased investments in RFID solutions that align with these initiatives.

Growing Demand for Efficient Asset Management

The data center-rfid market is experiencing a surge in demand for efficient asset management solutions. Organizations in India are increasingly recognizing the need to optimize their resources and reduce operational costs. RFID technology enables real-time tracking of assets, which can lead to improved inventory accuracy and reduced losses. According to industry estimates, the adoption of RFID in data centers can enhance asset visibility by up to 90%. This heightened visibility not only streamlines operations but also supports better decision-making processes. As companies strive for operational excellence, the data center-rfid market is poised to benefit from this growing emphasis on efficient asset management.

Increasing Regulatory Compliance Requirements

The data center-rfid market is significantly influenced by the increasing regulatory compliance requirements in India. Organizations are mandated to adhere to various standards related to data security and operational transparency. RFID technology offers a robust solution for maintaining compliance by providing accurate tracking and reporting capabilities. This is particularly relevant in sectors such as finance and healthcare, where data integrity is paramount. As companies invest in RFID systems to meet these regulatory demands, the data center-rfid market is expected to expand. The ability to demonstrate compliance through RFID tracking can also enhance an organization's reputation and trustworthiness.