Growing Awareness of Infection Control

The market is increasingly driven by a growing awareness of infection control measures within healthcare settings. Hospitals in India are recognizing the importance of maintaining hygiene and preventing the spread of infections, particularly in surgical and critical care environments. RFID technology can play a crucial role in tracking sterilized equipment and ensuring that only properly sanitized items are used in patient care. This focus on infection control is likely to lead to a higher adoption rate of RFID systems, as healthcare providers seek to enhance safety protocols. Consequently, the healthcare rfid market is expected to see substantial growth as facilities prioritize infection prevention strategies.

Increasing Focus on Patient Experience

The market is also being propelled by an increasing focus on enhancing patient experience. Healthcare providers in India are adopting RFID technology to streamline patient flow and reduce wait times. By utilizing RFID tags for patient identification and tracking, hospitals can ensure that patients receive timely care, which is crucial for overall satisfaction. Studies indicate that hospitals implementing RFID solutions have seen a 25% improvement in patient throughput. This focus on patient-centric care is likely to foster further investment in RFID systems, thereby contributing to the growth of the healthcare rfid market. As patient expectations continue to rise, the integration of RFID technology will become essential for healthcare providers aiming to improve service quality.

Technological Advancements in RFID Systems

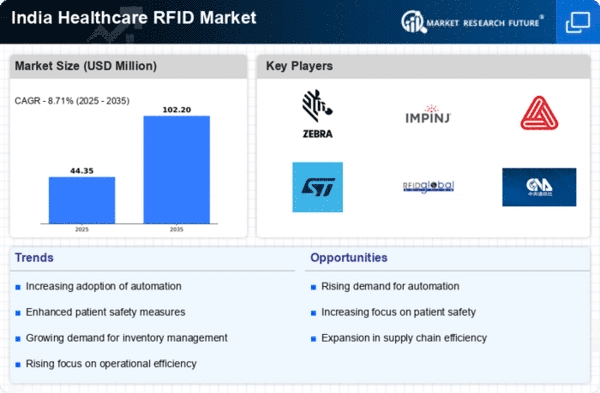

The healthcare rfid market is experiencing a surge due to rapid technological advancements in RFID systems. Innovations such as passive and active RFID tags, which offer improved tracking capabilities, are becoming increasingly prevalent. These advancements enable healthcare facilities to monitor assets and patients in real-time, thereby enhancing operational efficiency. In India, the market for RFID technology in healthcare is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for better inventory management and patient safety protocols. As hospitals and clinics adopt these technologies, the healthcare rfid market is likely to expand significantly, providing a robust framework for improved healthcare delivery.

Rising Demand for Efficient Asset Management

The healthcare rfid market is significantly influenced by the rising demand for efficient asset management solutions. Hospitals and healthcare facilities in India are increasingly recognizing the importance of tracking medical equipment and supplies to minimize losses and enhance service delivery. The implementation of RFID technology allows for real-time visibility of assets, which can lead to a reduction in operational costs by up to 30%. This efficiency not only streamlines workflows but also ensures that critical medical devices are readily available when needed. As the healthcare sector continues to evolve, the emphasis on asset management is expected to drive the growth of the healthcare rfid market, making it a vital component of modern healthcare infrastructure.

Government Initiatives Supporting Digital Health

The market is benefiting from various government initiatives aimed at supporting digital health solutions. The Indian government has been promoting the adoption of technology in healthcare through policies and funding, which encourages hospitals to invest in RFID systems. Initiatives such as the National Digital Health Mission aim to create a robust digital health ecosystem, which includes the integration of RFID technology for better tracking and management of healthcare resources. This supportive regulatory environment is likely to enhance the growth prospects of the healthcare rfid market, as more healthcare facilities seek to comply with government standards and improve operational efficiencies.