Increased Focus on Cybersecurity

As cyber threats become more sophisticated, the emphasis on cybersecurity is emerging as a critical driver for the data center-infrastructure market. Organizations in India are prioritizing the protection of sensitive data, leading to heightened investments in secure data center infrastructure. The market is witnessing a shift towards implementing advanced security measures, including encryption, firewalls, and intrusion detection systems. According to industry estimates, cybersecurity spending in India is expected to reach $3 billion by 2025, reflecting a growing recognition of the importance of safeguarding digital assets. This trend is likely to propel the data center-infrastructure market, as companies seek to enhance their security posture and ensure compliance with regulatory standards.

Growing Demand for Cloud Services

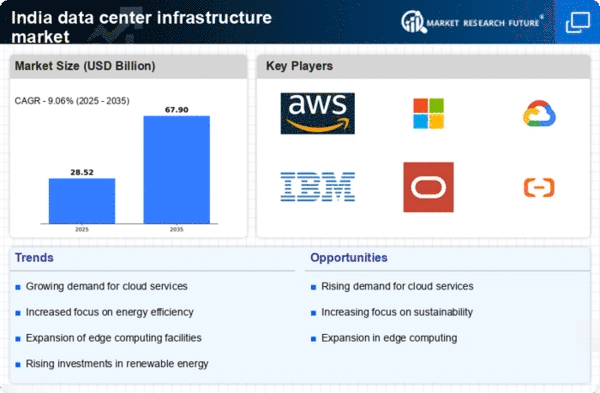

The increasing reliance on cloud services is a pivotal driver for the data center-infrastructure market. As businesses in India transition to cloud-based solutions, the demand for robust data center infrastructure intensifies. Reports indicate that the cloud computing market in India is projected to reach $10 billion by 2025, reflecting a compound annual growth rate (CAGR) of approximately 30%. This surge necessitates the expansion and enhancement of data center facilities to accommodate the growing data storage and processing needs. Consequently, service providers are compelled to invest in advanced infrastructure, ensuring scalability and reliability. The The data center infrastructure market is positioned to benefit significantly from this trend. Organizations seek to optimize their operations through cloud adoption.

Adoption of Renewable Energy Sources

The increasing awareness of environmental sustainability is driving the adoption of renewable energy sources within the data center-infrastructure market. Organizations in India are recognizing the need to reduce their carbon footprint and are actively seeking energy-efficient solutions. The integration of renewable energy, such as solar and wind, into data center operations is becoming more prevalent. Reports suggest that data centers powered by renewable energy could reduce operational costs by up to 30%, making them an attractive option for businesses. This shift not only aligns with global sustainability goals but also positions the data center-infrastructure market for growth as companies strive to meet their energy efficiency targets.

Regulatory Compliance and Data Sovereignty

In India, regulatory compliance and data sovereignty are increasingly influencing the data center-infrastructure market. The government has implemented stringent data protection laws, compelling organizations to store and process data within national borders. This regulatory landscape drives the demand for local data centers, as companies strive to adhere to compliance requirements. The data localization mandate, which requires certain types of data to be stored in India, is expected to propel investments in data center infrastructure. As a result, the market is likely to witness a surge in the establishment of data centers, with an estimated growth of 20% in infrastructure investments over the next few years. This trend underscores the importance of regulatory frameworks in shaping the data center-infrastructure market.

Rise of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in India are significantly impacting the data center-infrastructure market. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift necessitates the deployment of advanced data center infrastructure to support high-performance computing, data analytics, and real-time processing. The market is projected to grow at a CAGR of 25% as businesses invest in modernizing their IT infrastructure. Furthermore, sectors such as finance, healthcare, and retail are particularly focused on leveraging data-driven insights, thereby driving the demand for sophisticated data center solutions. The The data center infrastructure market is poised for substantial growth. This growth is driven by companies embracing digital transformation.