Government Policy Support

The Indian government is actively promoting the construction equipment market through various policy measures aimed at enhancing ease of doing business. Initiatives such as the Make in India campaign encourage domestic manufacturing of construction equipment, which could lead to reduced costs and improved availability. Furthermore, the introduction of the Goods and Services Tax (GST) has streamlined taxation, making it easier for companies to operate within the construction equipment market. These supportive policies are likely to attract foreign investment and foster innovation in the sector. As a result, the construction equipment market may witness increased competition and technological advancements, ultimately benefiting end-users through better products and services.

Rising Urbanization Trends

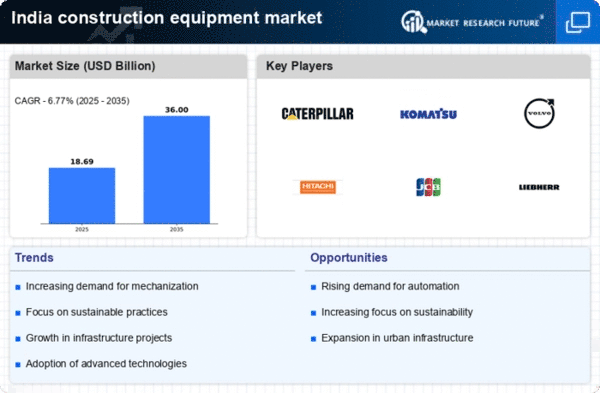

Urbanization in India is accelerating, with projections indicating that by 2031, approximately 600 million people will reside in urban areas. This rapid urban growth is a key driver for the construction equipment market, as it necessitates the development of housing, commercial spaces, and public infrastructure. The demand for construction equipment is likely to increase as builders and developers require efficient machinery to construct high-rise buildings and urban facilities. Additionally, the urbanization trend is accompanied by a growing middle class, which is expected to boost residential construction projects. As a result, the construction equipment market is poised for growth, with an anticipated CAGR of around 8% over the next five years.

Increased Private Sector Investment

Private sector investment in infrastructure projects is on the rise, contributing to the growth of the construction equipment market in India. With the government encouraging public-private partnerships (PPPs), private entities are increasingly participating in large-scale construction projects. This trend is expected to drive demand for advanced construction equipment, as private firms seek to enhance efficiency and reduce project timelines. Reports suggest that private investment in infrastructure could reach $200 billion by 2025, further stimulating the construction equipment market. As competition intensifies, companies may invest in modern machinery and technology to gain a competitive edge, thereby propelling market growth.

Infrastructure Development Initiatives

The construction equipment market in India is experiencing a surge due to extensive infrastructure development initiatives undertaken by the government. With the aim of enhancing connectivity and urbanization, projects such as the Bharatmala and Sagarmala initiatives are driving demand for construction equipment. The government has allocated substantial budgets, with an estimated $1 trillion earmarked for infrastructure projects over the next five years. This investment is likely to stimulate growth in the construction equipment market, as contractors and developers seek advanced machinery to meet project timelines and quality standards. Furthermore, the push for smart cities is expected to further elevate the demand for construction equipment, as urban areas require modernized infrastructure to support growing populations.

Technological Integration in Construction

The integration of advanced technologies in construction processes is transforming the construction equipment market in India. Innovations such as telematics, automation, and artificial intelligence are enhancing operational efficiency and safety on construction sites. As companies increasingly adopt these technologies, the demand for technologically advanced construction equipment is likely to rise. For instance, the use of drones for site surveys and monitoring is becoming more prevalent, indicating a shift towards more efficient construction practices. This technological evolution may lead to a more competitive landscape within the construction equipment market, as firms that leverage these advancements could achieve better project outcomes and cost savings.