Rising Demand for Housing

The construction aggregate market in India is experiencing a surge in demand driven by the increasing need for housing. With the government’s initiatives to provide affordable housing, the market is projected to grow significantly. According to recent estimates, the housing sector is expected to require approximately 1.2 billion tons of aggregates by 2030. This demand is further fueled by urban migration, as more individuals move to cities seeking better opportunities. Consequently, the construction aggregate market is likely to see a robust increase in production and supply to meet these housing demands. The focus on residential projects, particularly in urban areas, is anticipated to create a ripple effect, stimulating growth across related sectors such as transportation and logistics, thereby enhancing the overall construction aggregate market in India.

Growth in Commercial Construction

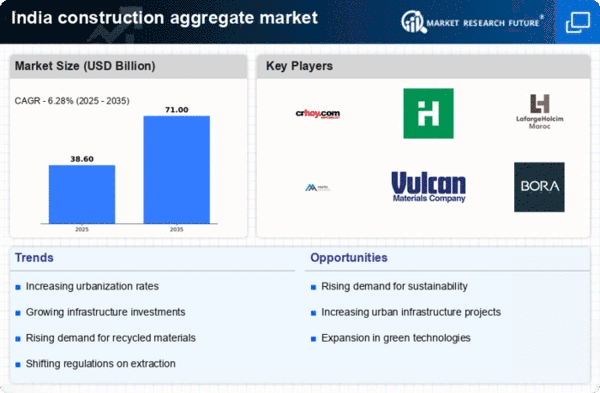

The commercial construction sector in India is witnessing a notable expansion, which is positively impacting the construction aggregate market. With the rise of IT parks, shopping malls, and office complexes, the demand for aggregates is projected to increase substantially. Recent data suggests that the commercial real estate market is expected to grow at a CAGR of 10% over the next five years. This growth is likely to drive the need for high-quality aggregates, as developers seek to meet the standards required for modern commercial buildings. Additionally, the trend towards mixed-use developments is further contributing to the demand for construction aggregates, as these projects often require diverse types of materials. As a result, the construction aggregate market is poised to benefit from the ongoing commercial construction boom in India.

Government Infrastructure Initiatives

The Indian government is actively investing in infrastructure development, which is a key driver for the construction aggregate market. Initiatives such as the Bharatmala and Sagarmala projects aim to enhance road and port connectivity, requiring substantial quantities of aggregates. Reports indicate that the government plans to invest over $1 trillion in infrastructure by 2025, which will significantly boost the demand for construction materials. This investment is expected to create numerous opportunities for aggregate suppliers and manufacturers, as the construction aggregate market will need to scale up production to meet the anticipated demand. Furthermore, the emphasis on building smart cities and improving urban infrastructure will likely lead to a sustained increase in the consumption of aggregates, thereby reinforcing the market's growth trajectory.

Technological Innovations in Production

Technological advancements are playing a pivotal role in transforming the construction aggregate market in India. Innovations in production techniques, such as automated crushing and screening processes, are enhancing efficiency and reducing costs. The adoption of advanced machinery and equipment is enabling manufacturers to produce higher quality aggregates with improved consistency. Additionally, the integration of data analytics and IoT technologies is facilitating better resource management and operational efficiency. Reports suggest that the implementation of these technologies could lead to a 15% reduction in production costs over the next few years. As the construction aggregate market continues to embrace these innovations, it is likely to experience increased competitiveness and improved sustainability, positioning itself favorably in the evolving construction landscape.

Increased Focus on Sustainable Practices

Sustainability is becoming a crucial consideration in the construction aggregate market, as stakeholders increasingly prioritize eco-friendly practices. The push for green building certifications and sustainable construction methods is leading to a demand for recycled aggregates and alternative materials. Recent studies indicate that the use of recycled aggregates can reduce the carbon footprint of construction projects by up to 30%. This shift towards sustainability is likely to reshape the construction aggregate market, as companies adapt to meet the evolving preferences of consumers and regulatory requirements. Furthermore, the integration of sustainable practices may enhance the market's resilience, as it aligns with global trends towards environmental responsibility. As a result, the construction aggregate market in India is expected to evolve, incorporating innovative solutions that promote sustainability.