Urbanization Trends

Urbanization continues to be a significant driver for the construction aggregate market in the United States. As more individuals migrate to urban areas, the demand for housing, commercial buildings, and infrastructure rises. The U.S. Census Bureau indicates that urban areas are expected to grow by 2.5 million residents annually, necessitating the construction of new facilities and infrastructure. This trend creates a robust demand for construction aggregates, as they are essential materials for various construction projects. The construction aggregate market is likely to experience sustained growth as urbanization drives the need for more residential and commercial developments, thereby increasing aggregate consumption.

Green Building Practices

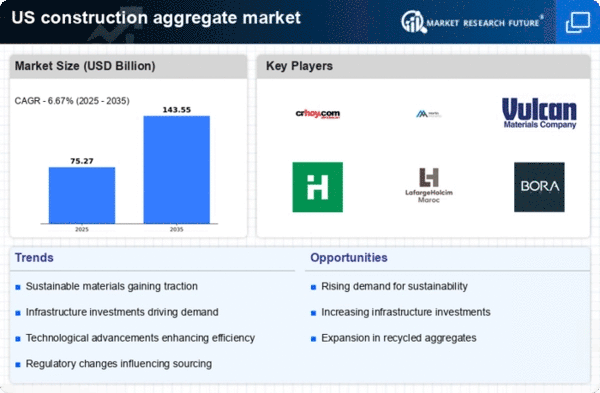

The construction aggregate market is influenced by the rising adoption of green building practices in the United States. As environmental concerns gain prominence, builders and developers are increasingly seeking sustainable materials and methods. The U.S. Green Building Council reports that green building projects are expected to account for over 40% of new construction by 2025. This shift towards sustainability is likely to drive demand for recycled aggregates and other eco-friendly materials, thereby impacting the construction aggregate market. Companies that adapt to these trends may find new opportunities for growth, as the market increasingly favors sustainable practices.

Economic Recovery and Growth

The construction aggregate market is benefiting from the ongoing economic recovery in the United States. As the economy strengthens, consumer confidence rises, leading to increased investments in residential and commercial construction. The U.S. Bureau of Economic Analysis projects a GDP growth rate of 3% in 2025, which is expected to stimulate construction activities. This economic growth is likely to result in heightened demand for construction aggregates, as builders seek to capitalize on favorable market conditions. Consequently, the construction aggregate market may experience a surge in activity, with potential implications for pricing and supply chain dynamics.

Infrastructure Investment Growth

The construction aggregate market is poised for growth due to increased infrastructure investment across the United States. Federal and state governments are allocating substantial budgets for infrastructure projects, including roads, bridges, and public transportation systems. In 2025, the U.S. government plans to invest approximately $1 trillion in infrastructure, which is expected to drive demand for construction aggregates. This surge in investment is likely to create a ripple effect, stimulating the construction sector and consequently increasing the consumption of aggregates. As infrastructure projects ramp up, the construction aggregate market will benefit from heightened activity, leading to a potential increase in market value and expansion opportunities for suppliers.

Technological Integration in Construction

Technological advancements are reshaping the construction aggregate market by enhancing efficiency and productivity in construction processes. The integration of technologies such as Building Information Modeling (BIM) and automation is streamlining operations, reducing waste, and optimizing resource allocation. According to industry reports, the adoption of these technologies could lead to a 20% reduction in construction costs by 2025. As construction firms increasingly leverage technology, the demand for high-quality aggregates that meet specific project requirements is likely to rise. This trend suggests that the construction aggregate market will evolve, with a focus on innovation and improved material performance.