Rising Energy Demand

The increasing energy demand in Germany is a crucial driver for the biomass gasification market. As the country transitions towards renewable energy sources, the need for sustainable and efficient energy production methods becomes paramount. Biomass gasification offers a viable solution by converting organic materials into syngas, which can be utilized for electricity generation and heat production. In 2025, Germany's energy consumption is projected to rise by approximately 1.5% annually, necessitating innovative energy solutions. This trend indicates a growing market for biomass gasification technologies, as they can help meet energy needs while reducing greenhouse gas emissions. The biomass gasification market is thus positioned to play a significant role in Germany's energy landscape, aligning with national goals for sustainability and energy independence.

Environmental Regulations

Germany's stringent environmental regulations are driving the biomass gasification market. The country has set ambitious targets for reducing carbon emissions, aiming for a 55% reduction by 2030 compared to 1990 levels. These regulations encourage the adoption of cleaner technologies, including biomass gasification, which converts waste into energy with lower emissions than traditional fossil fuels. The market is likely to benefit from policies that promote waste-to-energy solutions, as they align with the European Union's Green Deal objectives. Furthermore, the biomass gasification market is expected to gain traction as industries seek to comply with these regulations, potentially leading to increased investments in gasification technologies and infrastructure.

Technological Innovations

Technological innovations in biomass gasification processes are significantly influencing the market in Germany. Advances in gasification technologies, such as improved reactor designs and enhanced feedstock processing, are making biomass gasification more efficient and cost-effective. For instance, the development of integrated gasification combined cycle (IGCC) systems is enhancing energy conversion efficiencies, potentially exceeding 40%. These innovations not only improve the economic viability of biomass gasification but also expand the range of feedstocks that can be utilized, including agricultural residues and municipal solid waste. As these technologies continue to evolve, the biomass gasification market is likely to experience growth, driven by increased operational efficiencies and reduced costs.

Investment in Renewable Energy

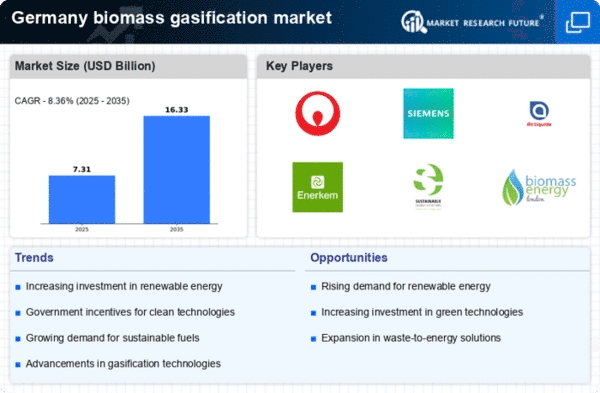

The growing investment in renewable energy projects in Germany is a significant driver for the biomass gasification market. In 2025, investments in renewable energy are expected to reach approximately €30 billion, with a substantial portion allocated to biomass technologies. This influx of capital is likely to enhance research and development efforts, leading to more efficient gasification systems and broader adoption across various sectors. The biomass gasification market stands to benefit from this trend, as stakeholders seek to diversify their energy portfolios and reduce reliance on fossil fuels. Furthermore, public-private partnerships are emerging, facilitating the development of biomass gasification facilities and infrastructure, thereby bolstering market growth.

Public Awareness and Acceptance

Public awareness and acceptance of renewable energy solutions are increasingly influencing the biomass gasification market in Germany. As citizens become more informed about the environmental benefits of biomass gasification, there is a growing demand for sustainable energy sources. Surveys indicate that over 70% of the population supports the use of biomass for energy production, recognizing its potential to reduce waste and lower carbon footprints. This societal shift is prompting policymakers to prioritize biomass gasification initiatives, leading to favorable regulations and incentives. Consequently, the biomass gasification market is likely to expand as public support translates into increased funding and development of gasification projects, aligning with Germany's commitment to a sustainable energy future.