Rising Geriatric Population

The increasing geriatric population in India is a crucial driver for the biliary catheters market. As the population ages, the prevalence of biliary disorders is expected to rise, necessitating effective treatment options. By 2025, it is estimated that the elderly population in India will exceed 140 million, with a significant portion likely to experience biliary-related health issues. This demographic shift creates a growing demand for biliary catheters, as older adults are more susceptible to conditions requiring catheterization. Healthcare providers are thus compelled to enhance their offerings in this area, leading to an expansion of the biliary catheters market. The focus on geriatric care and the need for specialized medical devices tailored to this population further underscore the importance of this driver.

Increasing Healthcare Expenditure

The rising healthcare expenditure in India is a pivotal driver for the biliary catheters market. As the government and private sectors allocate more funds towards healthcare, the demand for advanced medical devices, including biliary catheters, is likely to increase. In 2025, healthcare spending in India is projected to reach approximately $370 billion, reflecting a growth rate of around 12% annually. This increase in expenditure facilitates the adoption of innovative technologies and enhances the availability of quality healthcare services. Consequently, hospitals and healthcare facilities are more inclined to invest in biliary catheters, thereby propelling market growth. The emphasis on improving healthcare infrastructure and access to treatment options further supports the expansion of the biliary catheters market, as patients seek effective solutions for biliary disorders.

Government Initiatives and Policies

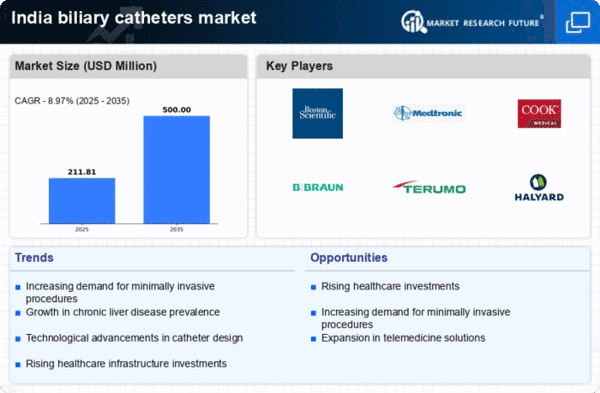

Government initiatives and policies aimed at improving healthcare access and quality are instrumental in driving the biliary catheters market. The Indian government has implemented various schemes to enhance healthcare infrastructure, including the National Health Mission, which focuses on providing affordable healthcare services. These initiatives are likely to increase the availability of biliary catheters in hospitals and clinics across the country. Furthermore, regulatory support for medical devices is expected to streamline the approval process, encouraging manufacturers to introduce innovative products. As a result, the biliary catheters market is projected to grow at a rate of around 8% annually, bolstered by these supportive policies. The emphasis on public health and the promotion of advanced medical technologies align with the overall goal of improving patient outcomes in India.

Growing Awareness of Biliary Disorders

There is a notable increase in awareness regarding biliary disorders among the Indian population, which serves as a significant driver for the biliary catheters market. Educational campaigns and healthcare initiatives have contributed to a better understanding of conditions such as cholangitis and biliary obstruction. As awareness rises, patients are more likely to seek medical attention, leading to an increased demand for diagnostic and therapeutic procedures involving biliary catheters. The market is expected to witness a growth rate of approximately 10% annually, driven by this heightened awareness. Furthermore, healthcare professionals are increasingly emphasizing early diagnosis and treatment, which further stimulates the need for biliary catheters in clinical settings. This trend indicates a shift towards proactive healthcare, ultimately benefiting the biliary catheters market.

Technological Innovations in Medical Devices

Technological innovations in medical devices are significantly influencing the biliary catheters market. The introduction of advanced materials and designs enhances the efficacy and safety of biliary catheters, making them more appealing to healthcare providers. Innovations such as biocompatible materials and improved catheter designs reduce the risk of complications and improve patient outcomes. In 2025, the market for advanced biliary catheters is anticipated to grow by approximately 15%, driven by these technological advancements. Additionally, the integration of digital technologies, such as smart catheters with monitoring capabilities, is likely to revolutionize the way biliary disorders are managed. This trend not only enhances the performance of biliary catheters but also aligns with the broader movement towards personalized medicine, thereby fostering growth in the biliary catheters market.