Rising Healthcare Expenditure

The increasing healthcare expenditure in the United States is a significant driver for the biliary catheters market. As healthcare budgets expand, hospitals and clinics are more inclined to invest in advanced medical technologies, including biliary catheters. This trend is supported by the growing emphasis on improving patient outcomes and the efficiency of healthcare delivery. According to recent statistics, healthcare spending in the US is projected to reach approximately $4 trillion by 2025, which will likely facilitate the procurement of innovative biliary catheter solutions. Consequently, this financial commitment to healthcare is expected to bolster the growth of the biliary catheters market.

Advancements in Catheter Technology

Technological innovations in catheter design and materials are significantly influencing the biliary catheters market. Recent advancements have led to the development of catheters that are more flexible, biocompatible, and easier to insert, enhancing patient comfort and procedural efficiency. For instance, the introduction of hydrophilic coatings has improved the ease of insertion and reduced complications associated with catheter placement. Furthermore, the integration of imaging technologies into catheter systems allows for better visualization during procedures, potentially improving outcomes. As these technologies continue to evolve, they are likely to attract more healthcare facilities to adopt advanced biliary catheters, thereby expanding the market.

Growing Awareness of Biliary Health

There is a notable increase in awareness regarding biliary health among both healthcare professionals and patients, which is positively impacting the biliary catheters market. Educational initiatives and campaigns aimed at highlighting the importance of early diagnosis and treatment of biliary disorders are gaining traction. This heightened awareness is leading to more patients seeking medical attention for biliary issues, resulting in an increased demand for biliary catheters. Additionally, healthcare providers are becoming more proactive in recommending catheterization as a treatment option, further driving market growth. The overall impact of this awareness is expected to contribute to a robust growth trajectory for the biliary catheters market.

Regulatory Support for Medical Devices

Regulatory frameworks in the United States are increasingly supportive of the development and approval of medical devices, including biliary catheters. The Food and Drug Administration (FDA) has streamlined processes for the approval of innovative catheter technologies, which encourages manufacturers to invest in research and development. This regulatory environment fosters competition and innovation within the biliary catheters market, as companies strive to meet the evolving needs of healthcare providers and patients. As a result, the market is likely to see a surge in new product launches and enhancements, contributing to its overall growth.

Increasing Incidence of Biliary Disorders

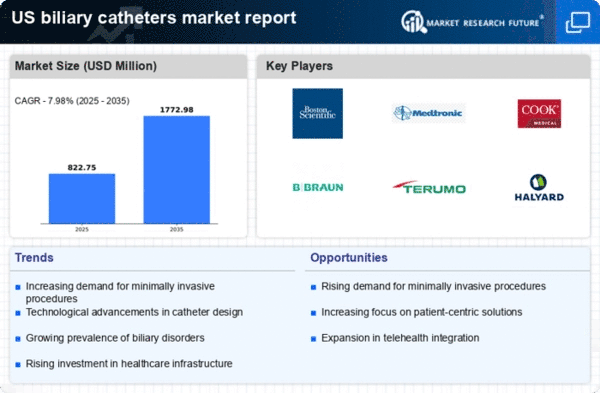

The rising prevalence of biliary disorders, such as cholangitis and biliary obstruction, is a primary driver for the biliary catheters market. According to recent data, the incidence of these conditions has been steadily increasing, leading to a greater need for effective drainage solutions. This trend is particularly evident in the aging population, where the risk of biliary diseases escalates. As healthcare providers seek to address these challenges, the demand for biliary catheters is expected to grow. The biliary catheters market is projected to witness a compound annual growth rate (CAGR) of approximately 6% over the next few years, driven by the need for innovative and reliable catheter solutions to manage these disorders.