India Battery Material Market Summary

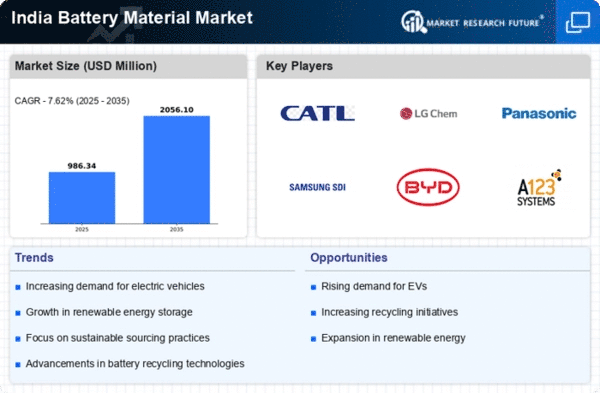

As per Market Research Future analysis, the India battery material market Size was estimated at 916.5 USD Million in 2024. The India battery material market is projected to grow from 986.34 USD Million in 2025 to 2056.1 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The India battery material market is poised for substantial growth driven by sustainability and technological advancements.

- Sustainable material development is becoming a focal point in the India battery material market.

- Technological advancements in battery chemistry are enhancing performance and efficiency across various applications.

- The largest segment in this market is the lithium-ion battery materials, while the fastest-growing segment is expected to be solid-state battery materials.

- Rising demand for electric vehicles and supportive government policies are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 916.5 (USD Million) |

| 2035 Market Size | 2056.1 (USD Million) |

| CAGR (2025 - 2035) | 7.62% |

Major Players

Contemporary Amperex Technology Co Ltd (CN), LG Chem Ltd (KR), Panasonic Corporation (JP), Samsung SDI Co Ltd (KR), BYD Company Limited (CN), A123 Systems LLC (US), SK Innovation Co Ltd (KR), Tianjin Lishen Battery Joint-Stock Co Ltd (CN)