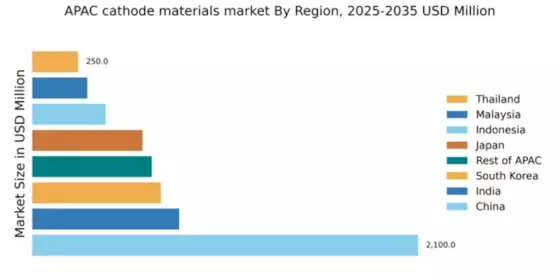

China : Unmatched Growth and Innovation

Key markets include Shanghai, Beijing, and Shenzhen, where major players like CATL and LG Chem dominate. The competitive landscape is characterized by aggressive R&D and strategic partnerships, enhancing product offerings. Local dynamics favor large-scale production capabilities, with a focus on high-performance materials for EVs and energy storage systems. The business environment is conducive, supported by favorable government policies and a growing demand for sustainable energy solutions.

India : Rapid Growth in EV Sector

Key markets include Delhi, Maharashtra, and Karnataka, where companies like A123 Systems and LG Chem are establishing a presence. The competitive landscape is evolving, with local startups entering the market alongside established players. The business environment is improving, aided by government support and a growing focus on renewable energy applications in transportation and grid storage. The sector is poised for significant growth as infrastructure develops further.

Japan : Innovation and Quality at Forefront

Key markets include Tokyo, Osaka, and Aichi, where major players like Panasonic and Toshiba are prominent. The competitive landscape is marked by high-quality standards and innovation, with companies investing heavily in next-generation materials. Local dynamics favor collaboration between industry and academia, enhancing technological advancements. The business environment is stable, supported by a strong regulatory framework and a focus on sustainable energy solutions.

South Korea : Leading in Advanced Technologies

Key markets include Seoul and Incheon, where major players like Samsung SDI and SK Innovation are based. The competitive landscape is characterized by rapid technological advancements and strategic collaborations. Local dynamics favor large-scale production and innovation, with a focus on high-performance materials for EVs and energy storage. The business environment is robust, supported by government incentives and a growing demand for sustainable energy solutions.

Malaysia : Strategic Location and Investment

Key markets include Selangor and Penang, where companies are establishing production facilities. The competitive landscape is evolving, with both local and international players vying for market share. The business environment is improving, aided by government support and a focus on renewable energy applications. The sector is poised for growth as infrastructure develops and demand for sustainable energy solutions increases.

Thailand : Investment and Growth Opportunities

Key markets include Bangkok and Chonburi, where companies are establishing production facilities. The competitive landscape is characterized by a mix of local and international players, with a focus on innovation and quality. The business environment is improving, supported by government incentives and a growing demand for sustainable energy solutions. The sector is poised for growth as infrastructure develops and demand for battery technologies increases.

Indonesia : Potential for Growth and Innovation

Key markets include Jakarta and West Java, where companies are establishing production facilities. The competitive landscape is evolving, with both local and international players vying for market share. The business environment is improving, aided by government support and a focus on renewable energy applications. The sector is poised for growth as infrastructure develops and demand for sustainable energy solutions increases.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include Vietnam, Philippines, and Singapore, where local players are emerging alongside established international firms. The competitive landscape is diverse, with varying levels of innovation and investment. Local dynamics favor tailored solutions to meet specific market needs, with a focus on sustainable energy applications. The business environment is improving, supported by government initiatives and a growing demand for battery technologies.