Government Initiatives and Policies

Government initiatives and policies aimed at boosting the automotive sector are crucial drivers for the India Automotive Wiring Harness Market. The Indian government has implemented various schemes, such as the Production Linked Incentive (PLI) scheme, to encourage local manufacturing and reduce dependency on imports. In 2023, the automotive sector received substantial financial support, with allocations exceeding USD 3 billion for infrastructure development and technology upgrades. These initiatives not only foster a conducive environment for manufacturers but also stimulate demand for wiring harnesses, as they are integral components in modern vehicles. The focus on enhancing domestic production capabilities is likely to further bolster the market.

Rising Demand for Passenger Vehicles

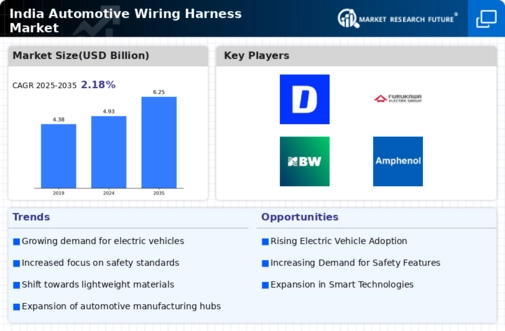

The increasing demand for passenger vehicles in India is a pivotal driver for the India Automotive Wiring Harness Market. As urbanization accelerates and disposable incomes rise, more consumers are opting for personal vehicles. In 2023, the passenger vehicle segment accounted for approximately 45% of the total automotive market in India. This trend is expected to continue, with projections indicating a compound annual growth rate (CAGR) of around 10% over the next five years. Consequently, the demand for wiring harnesses, which are essential for the electrical systems in these vehicles, is likely to surge. This growth is further supported by the government's initiatives to enhance road infrastructure, making personal transportation more accessible and appealing.

Growth of the Electric Vehicle Segment

The growth of the electric vehicle (EV) segment is emerging as a transformative driver for the India Automotive Wiring Harness Market. With the government's commitment to promoting electric mobility, the EV market is projected to expand significantly, with estimates suggesting a CAGR of over 30% in the coming years. This shift necessitates specialized wiring harnesses designed to accommodate the unique requirements of electric vehicles, such as high-voltage systems and advanced battery management. As manufacturers adapt to this evolving landscape, the demand for innovative wiring solutions is expected to increase, thereby creating new opportunities within the market.

Technological Advancements in Automotive Manufacturing

Technological advancements in automotive manufacturing are significantly influencing the India Automotive Wiring Harness Market. The adoption of automation and robotics in production processes has led to increased efficiency and reduced costs. In 2023, the Indian automotive sector invested over USD 1 billion in advanced manufacturing technologies, which is expected to yield higher quality wiring harnesses. Moreover, the integration of Industry 4.0 practices is enhancing supply chain management and production capabilities. As manufacturers strive to meet stringent quality standards and consumer expectations, the demand for sophisticated wiring harness solutions is anticipated to rise, thereby propelling market growth.

Increasing Focus on Vehicle Safety and Comfort Features

The increasing focus on vehicle safety and comfort features is a notable driver for the India Automotive Wiring Harness Market. Consumers are becoming more discerning, prioritizing advanced safety technologies such as airbags, anti-lock braking systems, and infotainment systems. In 2023, the market for automotive safety features in India was valued at approximately USD 5 billion, reflecting a growing trend towards enhanced vehicle safety. This demand translates into a higher requirement for complex wiring harnesses that support these features. As manufacturers strive to meet consumer expectations and regulatory standards, the wiring harness market is likely to experience substantial growth, driven by the need for reliable and efficient electrical systems.