Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is a primary driver for the In-vivo Imaging Market. As these diseases become more prevalent, the demand for advanced imaging techniques to facilitate early diagnosis and effective treatment planning intensifies. According to recent estimates, the number of cancer cases is projected to rise significantly, necessitating innovative imaging solutions. This trend underscores the importance of in-vivo imaging technologies, which provide critical insights into disease progression and treatment efficacy. Consequently, healthcare providers are increasingly investing in advanced imaging modalities, thereby propelling the growth of the In-vivo Imaging Market.

Technological Innovations in Imaging Modalities

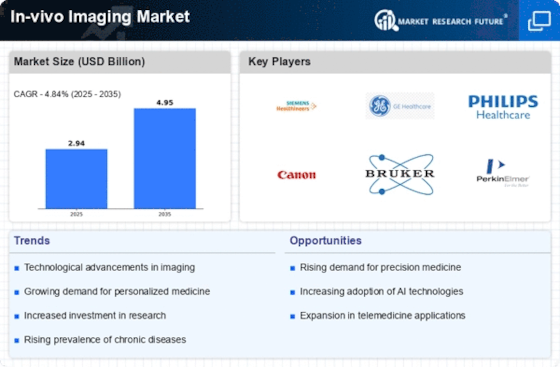

Technological advancements in imaging modalities, including MRI, PET, and CT scans, are transforming the In-vivo Imaging Market. Innovations such as hybrid imaging systems and enhanced imaging software are improving the accuracy and efficiency of diagnostic procedures. For instance, the integration of artificial intelligence in imaging analysis is streamlining workflows and enhancing diagnostic precision. The market for advanced imaging technologies is expected to witness substantial growth, with projections indicating a compound annual growth rate of over 10% in the coming years. These innovations not only improve patient outcomes but also drive the adoption of in-vivo imaging solutions across various healthcare settings.

Increased Investment in Research and Development

Investment in research and development within the healthcare sector is a crucial driver for the In-vivo Imaging Market. As stakeholders recognize the potential of advanced imaging technologies in enhancing diagnostic capabilities, funding for R&D initiatives is on the rise. This influx of investment is facilitating the development of novel imaging techniques and applications, thereby expanding the market landscape. Furthermore, collaborations between academic institutions and industry players are fostering innovation, leading to the introduction of cutting-edge imaging solutions. The emphasis on R&D is likely to propel the In-vivo Imaging Market forward, as new technologies emerge to meet evolving healthcare needs.

Regulatory Support for Advanced Imaging Technologies

Regulatory bodies are increasingly supporting the development and adoption of advanced imaging technologies, which is positively impacting the In-vivo Imaging Market. Streamlined approval processes and favorable policies are encouraging manufacturers to innovate and bring new imaging solutions to market. This regulatory support is particularly evident in the approval of novel imaging agents and devices that enhance diagnostic accuracy. As regulatory frameworks evolve to accommodate advancements in imaging technology, the market is expected to experience accelerated growth. The alignment of regulatory initiatives with technological progress is likely to create a conducive environment for the expansion of the In-vivo Imaging Market.

Growing Demand for Non-Invasive Diagnostic Techniques

The shift towards non-invasive diagnostic techniques is significantly influencing the In-vivo Imaging Market. Patients and healthcare providers alike are increasingly favoring methods that minimize discomfort and risk associated with traditional invasive procedures. Non-invasive imaging techniques, such as ultrasound and advanced MRI, offer valuable insights without the need for surgical intervention. This trend is particularly relevant in the context of chronic disease management, where timely and accurate diagnosis is crucial. As a result, the demand for non-invasive imaging solutions is expected to rise, further stimulating the growth of the In-vivo Imaging Market.