Market Analysis

In-depth Analysis of In mold Labels Market Industry Landscape

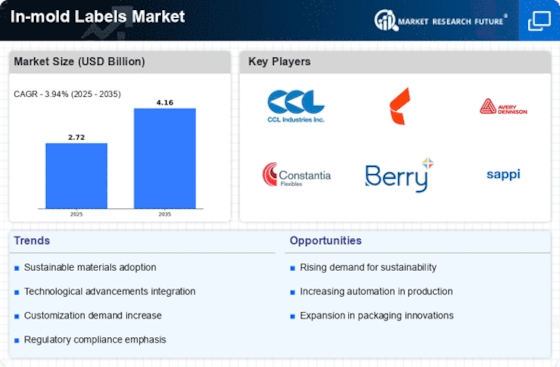

The in-mold labels (IML) market is marked by dynamic forces that significantly influence its growth trajectory and evolution. These market dynamics are shaped by a combination of factors including technological advancements, consumer preferences, regulatory requirements, competitive pressures, and economic conditions. Understanding these dynamics is crucial for stakeholders to effectively navigate the complexities of the in-mold labels market and make informed decisions.

As in-mold labeling and decorating are accomplished using plastic injection molded process, no subordinate procedures are required further, thus, excludes post-molding labeling process, reduces decorating labor, equipment costs, and time. As the packaging and labelling are manufactured using the same material, the package manufactured is totally biodegradable. As in-mold labels provide lightweight product development and ability to stack tightly, which results in reduced delivery discharges, less space consumption, and a much lighter and smaller transportation footprint. In-mold labels indulge less breakage waste and are safer than metals and glass.

Technological advancements play a pivotal role in driving market dynamics within the in-mold labels industry. Continuous innovation in printing technologies, materials science, and manufacturing processes has led to the development of advanced in-mold labeling solutions. For instance, advancements in digital printing technology have enabled high-quality, customizable labels with intricate designs and vibrant colors, enhancing the visual appeal of products. Additionally, improvements in label materials and adhesives have resulted in labels that offer superior durability, resistance to moisture, and enhanced product protection, meeting the stringent requirements of various end-use applications.

Consumer preferences also significantly influence market dynamics in the in-mold labels industry. With increasing emphasis on product aesthetics, brand differentiation, and sustainability, consumers are driving demand for in-mold labels that offer superior visual appeal and environmental benefits. In-mold labels provide a seamless and visually appealing labeling solution that enhances product visibility and shelf appeal, thereby influencing consumer purchasing decisions. Moreover, the growing demand for eco-friendly packaging solutions has spurred the adoption of in-mold labels made from recyclable materials, aligning with consumer preferences for sustainable products.

Regulatory requirements and compliance standards are key drivers of market dynamics in the in-mold labels industry, particularly in sectors such as food and beverage packaging, cosmetics, and pharmaceuticals. Government regulations pertaining to product labeling, safety, and traceability drive the adoption of in-mold labels with features such as tamper-evident seals, serialization codes, and regulatory compliance symbols. Compliance with regulatory requirements is essential for businesses to ensure legal compliance, protect consumer safety, and maintain market access, thereby influencing market dynamics.

Competitive pressures also shape market dynamics within the in-mold labels industry, with companies vying for market share by offering innovative labeling solutions, cost-effective products, and value-added services. Market competition drives continuous improvement and innovation in in-mold labeling technologies, as companies strive to differentiate themselves and meet the evolving needs of customers. Additionally, mergers, acquisitions, and partnerships within the industry contribute to market consolidation and restructuring, influencing the competitive landscape and market dynamics.

Moreover, economic factors such as GDP growth, consumer spending patterns, and industrial production levels impact the demand for in-mold labels across various end-use sectors. Economic fluctuations may affect the purchasing power of consumers and businesses, leading to fluctuations in demand for labeling products and services. Additionally, currency exchange rates, trade policies, and geopolitical factors can influence market dynamics by affecting international trade flows and supply chain operations.

Leave a Comment