Increased Investor Demand

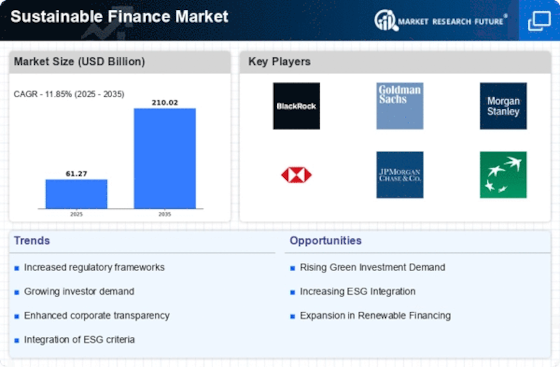

The Sustainable Finance Market is experiencing a notable surge in investor demand for sustainable investment options. This trend appears to be driven by a growing awareness of environmental, social, and governance (ESG) issues among investors. According to recent data, approximately 85% of investors express interest in sustainable investment opportunities, indicating a shift in priorities. This heightened demand is compelling financial institutions to innovate and offer a wider array of sustainable financial products. As a result, the Sustainable Finance Market is likely to expand, with more capital flowing into green bonds, sustainable mutual funds, and other ESG-compliant investment vehicles. This shift not only reflects changing consumer preferences but also suggests a potential long-term transformation in investment strategies across various sectors.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Sustainable Finance Market. Innovations in fintech, blockchain, and data analytics are enhancing transparency and efficiency in sustainable investments. For instance, blockchain technology is being utilized to track the provenance of green bonds, ensuring that funds are allocated to genuine sustainable projects. Furthermore, data analytics tools are enabling investors to assess the ESG performance of companies more effectively. This technological evolution appears to be fostering greater trust and engagement among investors, which could lead to increased participation in sustainable finance initiatives. As these technologies continue to evolve, they may further streamline processes and reduce costs, thereby enhancing the attractiveness of sustainable financial products in the market.

Regulatory Support and Frameworks

The Sustainable Finance Market is benefiting from an increasingly supportive regulatory environment. Governments and regulatory bodies are implementing frameworks that encourage sustainable investment practices. For example, the introduction of mandatory ESG disclosures for publicly listed companies is becoming more prevalent, which enhances transparency and accountability. This regulatory push appears to be fostering a culture of sustainability within the financial sector, as institutions are compelled to align their practices with national and international sustainability goals. Moreover, the establishment of green taxonomies and standards is likely to facilitate the growth of sustainable financial products, making it easier for investors to identify and invest in compliant offerings. This regulatory momentum could significantly bolster the Sustainable Finance Market, as it aligns financial incentives with sustainable development objectives.

Growing Awareness of Climate Change

The Sustainable Finance Market is witnessing a heightened awareness of climate change and its implications for financial stability. This awareness appears to be influencing both investors and institutions to prioritize sustainability in their financial decisions. Recent studies indicate that climate-related risks are increasingly recognized as material risks that can impact investment returns. As a result, financial institutions are beginning to integrate climate risk assessments into their investment strategies. This shift is likely to drive demand for sustainable financial products that mitigate climate risks, such as green bonds and climate-focused funds. The growing recognition of climate change as a critical issue may catalyze further investment in sustainable finance, as stakeholders seek to align their portfolios with a more sustainable future.

Corporate Sustainability Initiatives

The Sustainable Finance Market is increasingly influenced by corporate sustainability initiatives. Many companies are adopting comprehensive sustainability strategies, which often include commitments to reduce carbon emissions and enhance social responsibility. This trend appears to be driven by both consumer expectations and the recognition that sustainable practices can lead to long-term profitability. As corporations strive to meet these expectations, they are more likely to seek financing options that align with their sustainability goals. Consequently, the demand for sustainable finance products is expected to rise, as companies look for green bonds and other financing mechanisms that support their initiatives. This alignment between corporate strategies and sustainable finance could potentially reshape investment landscapes, as more businesses prioritize sustainability in their operations.