Technological Advancements

Technological advancements play a crucial role in propelling the Environmental Sensor Market forward. Innovations in sensor technology, such as miniaturization and enhanced data analytics capabilities, are enabling more accurate and efficient monitoring of environmental parameters. For instance, the development of low-cost, high-performance sensors has made it feasible for widespread deployment in various sectors, including agriculture, water management, and urban development. The market is witnessing a shift towards smart sensors that can communicate data in real-time, facilitating timely decision-making. This trend is supported by the increasing adoption of Internet of Things (IoT) solutions, which are expected to drive the market's growth. As a result, the Environmental Sensor Market is likely to experience a surge in demand for advanced sensor technologies that can provide actionable insights into environmental conditions.

Rising Environmental Concerns

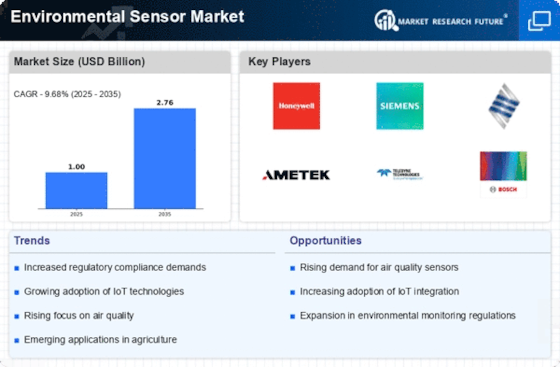

The increasing awareness of environmental issues is a primary driver for the Environmental Sensor Market. As climate change and pollution become more pressing concerns, governments and organizations are investing in technologies that monitor environmental conditions. This trend is reflected in the projected growth of the environmental sensor market, which is expected to reach USD 4.5 billion by 2026. The demand for sensors that can detect air quality, water quality, and soil conditions is surging, as stakeholders seek to mitigate environmental impacts. Furthermore, the integration of these sensors into various applications, such as agriculture and urban planning, highlights their importance in addressing environmental challenges. The Environmental Sensor Market is thus positioned to benefit from this heightened focus on sustainability and environmental protection.

Growing Demand for Smart Cities

The growing demand for smart cities is a pivotal driver for the Environmental Sensor Market. As urbanization accelerates, cities are increasingly adopting smart technologies to enhance sustainability and improve the quality of life for residents. Environmental sensors are integral to this transformation, providing real-time data on air quality, noise levels, and other environmental factors. This data is essential for city planners and policymakers to make informed decisions regarding urban development and resource management. The market for environmental sensors in smart cities is projected to grow significantly, as municipalities seek to implement solutions that promote environmental sustainability. Consequently, the Environmental Sensor Market is likely to see a surge in demand for sensors that can support the development of smart urban environments.

Increased Industrial Applications

The increased industrial applications of environmental sensors are driving growth in the Environmental Sensor Market. Industries such as manufacturing, oil and gas, and agriculture are increasingly recognizing the importance of monitoring environmental conditions to ensure compliance with regulations and enhance operational efficiency. For instance, sensors that monitor emissions and waste are becoming essential for industries aiming to reduce their environmental footprint. The market is witnessing a rise in demand for sensors that can provide real-time data on various environmental parameters, enabling industries to make data-driven decisions. This trend is expected to continue, as more companies adopt sustainable practices and seek to leverage technology for better environmental management. Thus, the Environmental Sensor Market is poised for growth as industrial applications expand.

Government Initiatives and Funding

Government initiatives and funding are significant drivers of the Environmental Sensor Market. Many governments are implementing policies aimed at improving environmental monitoring and management. For example, funding programs for research and development in environmental technologies are becoming more prevalent. These initiatives often focus on enhancing the capabilities of environmental sensors to monitor air and water quality, as well as other critical parameters. In addition, regulatory frameworks are being established to ensure compliance with environmental standards, further driving the demand for advanced sensor solutions. The Environmental Sensor Market is thus benefiting from increased public sector investment, which is expected to foster innovation and expand the market's reach across various applications.