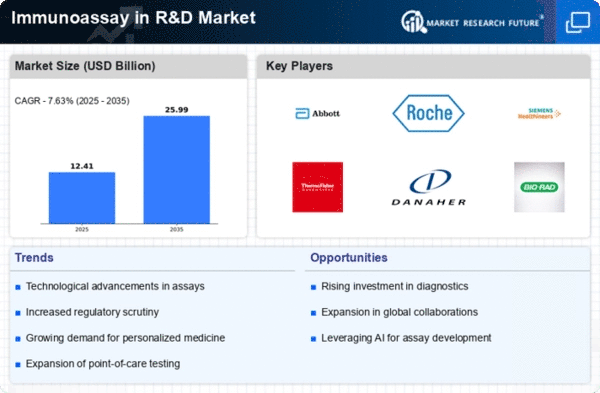

Market Growth Projections

The Global Immunoassays in R&D Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 10.4 USD Billion in 2024 and is expected to expand to 16.2 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 4.07% from 2025 to 2035. Such figures underscore the increasing reliance on immunoassays for various applications, including diagnostics and research. The anticipated growth is likely to attract new entrants and stimulate innovation, further enhancing the market landscape.

Rising Demand for Diagnostic Testing

The Global Immunoassays in R&D Market Industry experiences a notable surge in demand for diagnostic testing across various healthcare sectors. This trend is largely driven by the increasing prevalence of chronic diseases and the need for early detection and monitoring. For instance, the World Health Organization indicates that the global burden of diseases such as diabetes and cardiovascular conditions is escalating. Consequently, the market is projected to reach 10.4 USD Billion in 2024, reflecting a robust growth trajectory. This heightened demand for accurate and efficient diagnostic tools is likely to propel innovation within the immunoassay sector.

Growing Focus on Personalized Medicine

The shift towards personalized medicine significantly influences the Global Immunoassays in R&D Market Industry. As healthcare moves towards tailored treatment approaches, the demand for immunoassays that can provide specific biomarker information is increasing. This trend is particularly evident in oncology, where targeted therapies require precise patient stratification based on genetic and molecular profiles. The ability of immunoassays to deliver such insights positions them as essential tools in the development of personalized treatment regimens. Consequently, this growing focus on personalized medicine is anticipated to drive market growth, with projections indicating a market size of 16.2 USD Billion by 2035.

Regulatory Support and Standardization

Regulatory support and standardization are crucial factors impacting the Global Immunoassays in R&D Market Industry. Regulatory bodies are increasingly recognizing the importance of immunoassays in diagnostics and are establishing guidelines to ensure their efficacy and safety. This regulatory framework not only enhances consumer confidence but also encourages manufacturers to invest in the development of high-quality immunoassay products. Furthermore, standardization initiatives help streamline the approval process, facilitating quicker market entry for innovative solutions. As a result, the regulatory landscape is likely to foster a conducive environment for growth within the immunoassay sector.

Increasing Investment in Research and Development

Investment in research and development is a critical driver for the Global Immunoassays in R&D Market Industry. Governments and private entities are allocating substantial funds towards the development of novel immunoassay platforms and applications. For instance, various national health agencies are funding initiatives aimed at enhancing diagnostic capabilities for infectious diseases and cancer biomarkers. This influx of capital not only fosters innovation but also facilitates collaborations between academia and industry, leading to the emergence of new products. As the market evolves, the focus on R&D is likely to strengthen the competitive landscape and expand the range of available immunoassay solutions.

Technological Advancements in Immunoassay Techniques

Technological advancements play a pivotal role in shaping the Global Immunoassays in R&D Market Industry. Innovations such as multiplexing capabilities, enhanced sensitivity, and automation are transforming traditional immunoassay methods. For example, the development of high-throughput screening technologies allows for the simultaneous analysis of multiple targets, thereby increasing efficiency in research and clinical settings. These advancements not only improve the accuracy of results but also reduce turnaround times. As a result, the market is expected to witness a compound annual growth rate of 4.07% from 2025 to 2035, indicating a sustained interest in cutting-edge immunoassay technologies.